Your gain: Balance

your cash flow at risk

and value at risk

FX intelligence runs an automated analysis environment to deliver relevant decision data to FX treasuries. Our Goal: to improve business resilience and competitiveness.

Reinforced learning algorithms provide a condensed view of relevant developments, reduces the effort required for decisions and enables an improved balance between cash flow at risk and value at risk.

How FX decision data

are used best

Centralize treasury

Managing holdings and centralized treasuries can be a demanding strategic job. Our Event Alarms are the first step to control FX exposures and streamline decentralized activities.

Contact us for more info

Fund corporates

Highly volatile business environments as seen these times need proper funding. If FX gets involved our Event Alarms are one important step to support your funding strategy.

Contact us for more info

Manage risk

Automizing risk evaluations, creating “one voice” and succeeding in today’s times as “mother of tail events” need a clear address. FX intelligence and Event Alarms are here for your support.

Contact us for more info

Refine forecasts

Use Event Alarms to run your profitability forecasts on the most agile and reliable system on the market and follow international corporates’ best practice for forecasting FX developments and its impacts.

Contact us for more info

Create transparency

Establish company-wide transparency for your FX strategy decisions based on HedgeGo’s Event Alarm system. Include all decision makers to receive the same transparent data at the same time as you.

Contact us for more info

Run simulations

Before starting with FX Intelligence in practice, HedgeGo enables corporates to run simulations for their exposures. This useful feature shows all relevant KPIs for a further, fact-based FX decision process.

Contact us for more info

This is our contribution for the new generation of working capital management

Download

our “processes” manual

FX decision data helps treasuries in their daily business to better manage cash flows and reduce the negative impact of foreign currencies on the financial result. HedgeGo enables you to balance cash flow-at-risk and value-at-risk. Use the new generation of FX decision data to manage your FX risks faster, better and easier. In this manual, we dive into specific processes.

Download

our onboarding manual

From Event Alarms to decision data. Learn how our service runs in practice and how you can use it to your advantage. The most difficult decisions come when it comes to balancing cash flow-at- risk (cost of hedging) and value-at-risk to protect the balance sheet. FX decision data can help speed up processes, save time and better balance costs against risks as they arise.

Use case:

EUR | BRL Payables

A corporation is seated in the EU and buys goods in BRL. Each move in the exchange rate has direct impact to the financial result. Though, the corporation wants to protect itself against unfavourable exchange rates and thinks of hedging action. Based on our 22 year track record we delivered a superior result compared to other alternatives.

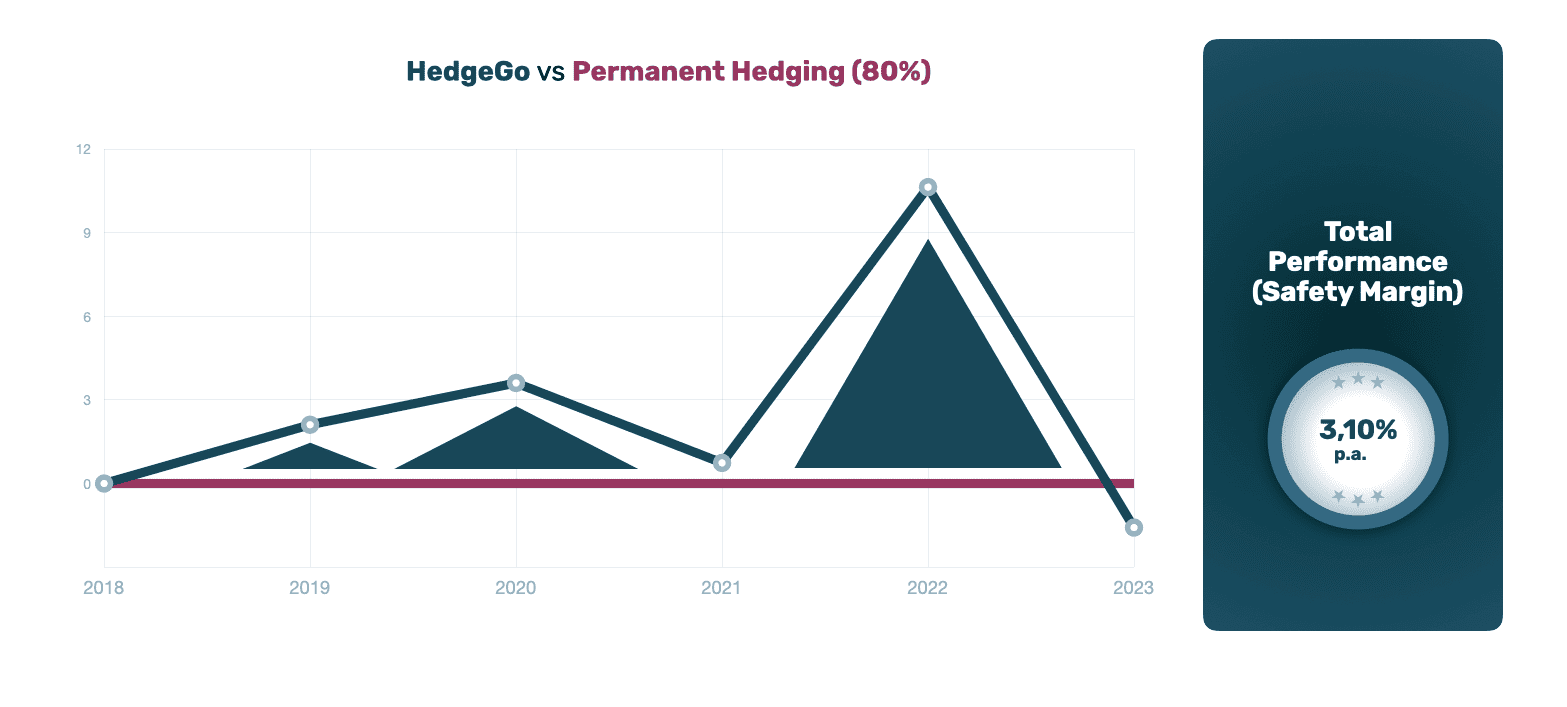

Use case:

EUR | USD Receivables

A corporation is seated in the EU and exports machines to the USA, managing revenues in USD. The past has shown, that their financial result was severely hit in certain years. As a result, the corporation wants to protect itself against unfavourable exchange rates and thinks of hedging action. See, how the HedgeGo Safety Margin has developed for them in past years.

NEW

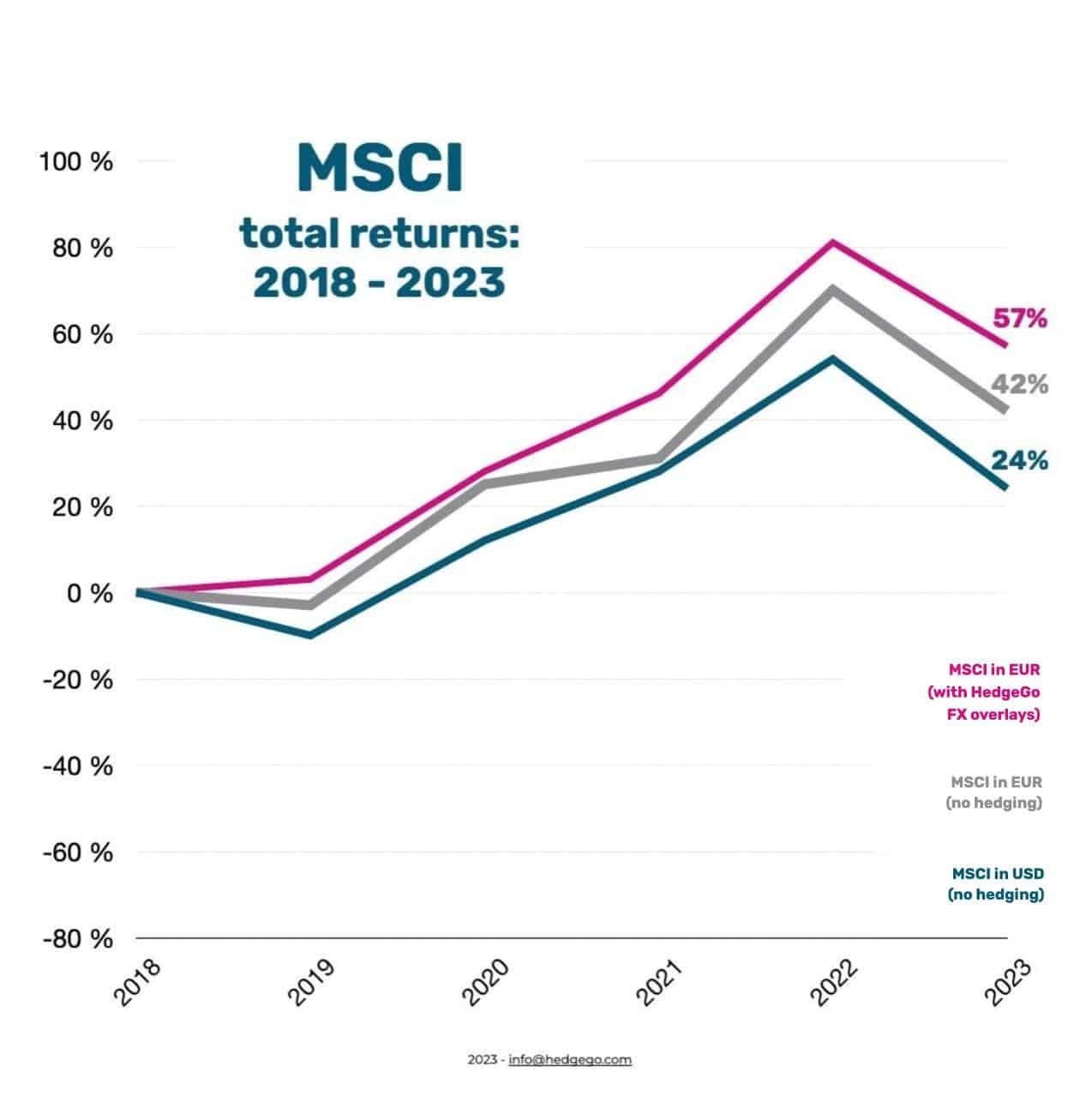

Use case:

FX overlays for investment funds

Use our Event Alarms to take advantage of positive exchange rate developments. The additional returns generated can be used for re-investments to achieve a measurable increase in value. Such a systematic strategy shows considerable success over a period of 5 years and sustainably improves your competitiveness over longer periods of time.

Need help with the implementation of decision data?

Renowned consulting firms support you to translate our FX intelligence into your proprietary processes.

Our treasury network partners are available at any time

TreasuryView is the easiest way to integrated interest rate, currency and loan management with time-saving automation. Daily treasury risk tasks and analyses, perfectly synchronised with daily market data.

FINIUS is a boutique specialising in operating model modernisation with roots in banking, IT and organisational development. Our experts redesign the operating models of banks and corporates – in a targeted, swift and sustainably effective manner.

TreasuryMastermind.com welcomes you. Join our growing community and become part of a network that values collaboration, expertise and the pursuit of excellence in corporate treasury.

We offer a comprehensive service for all financial issues that a company faces strategically and in its day-to-day business. Thanks to our many years of experience in Treasury & Finance, we are experts and create real added value for you.