FX Risk Management is Important…

However, market volatility, unpredictable rates, and the constant obligation to monitor trends may leave you exposed to unnecessary losses on the balance sheet and/or your cashflow.

How Do You Get the Most Out of Your FX Risk Management?

You can implement fixed processes, but not all areas of the business are suitable for them.

Additionally, you can:

1. Use basic forecasting tools or bank forecasts

2. Or leverage our expert know-how to optimize hedging decisions

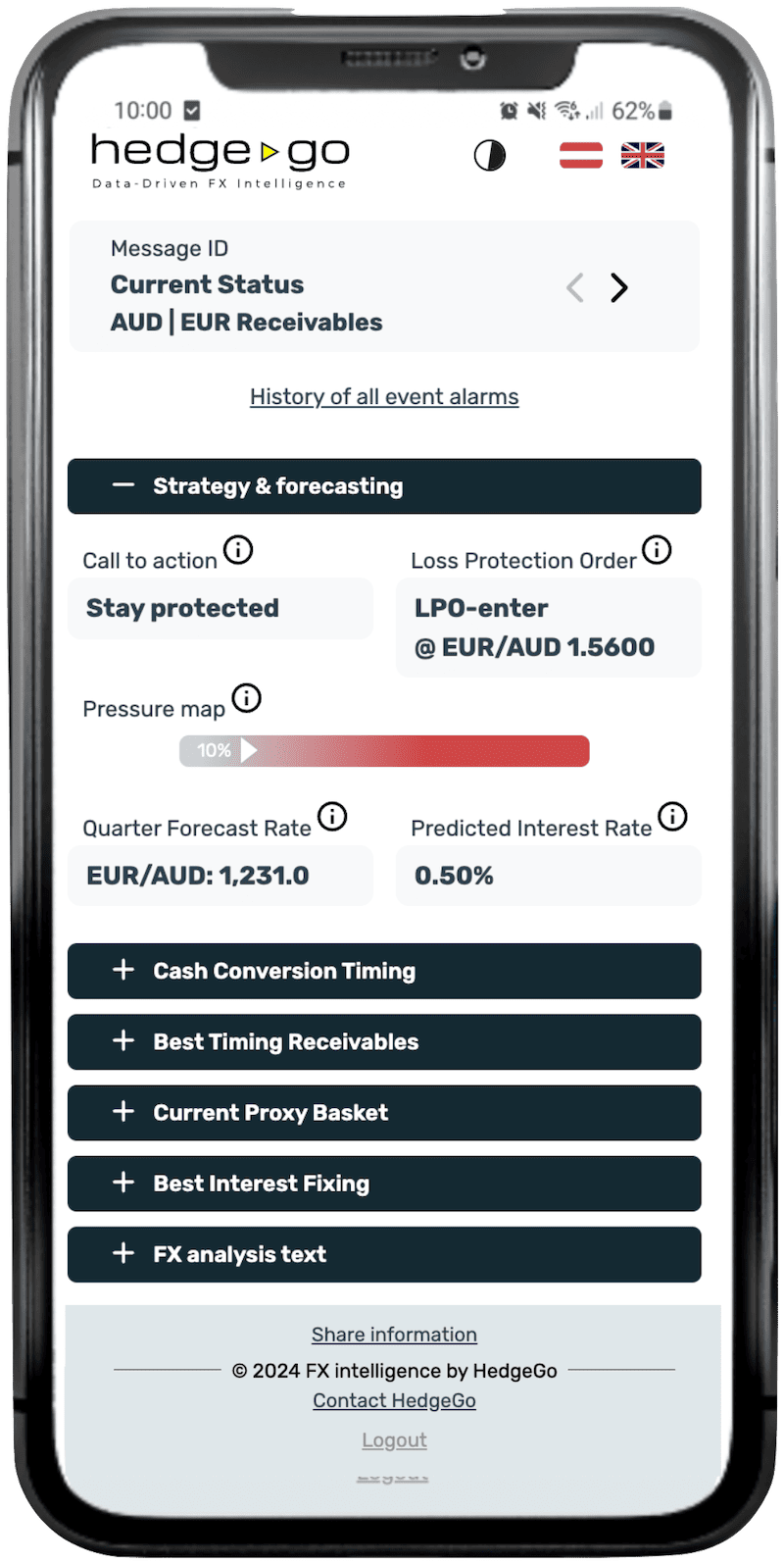

HedgeGo integrates 26 years of analytical experience with machine learning methods to create models for the systematic management of currency, commodity, and interest rate risks.

Want to see how this applies to your business?

Book a free call and let’s explore how HedgeGo can strengthen your FX risk management.

What Makes HedgeGo Different?

We transform inefficient processes into 3 automated, systematized, and data-driven solutions that provide a glimpse into the near future for improved decision-making.

Turn uncertainty into stability.

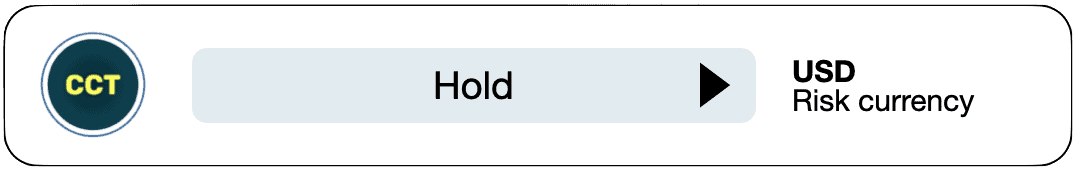

HedgeGo’s Cash Conversion Timing (CCT) helps your company convert foreign currency receivables at the optimal time, minimizing exchange rate risks and relieving your treasury of the repetetive tasks.

It uses machine learning models behind the scenes to predict currency trends.

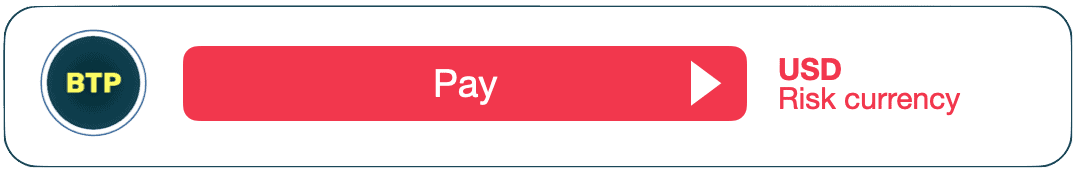

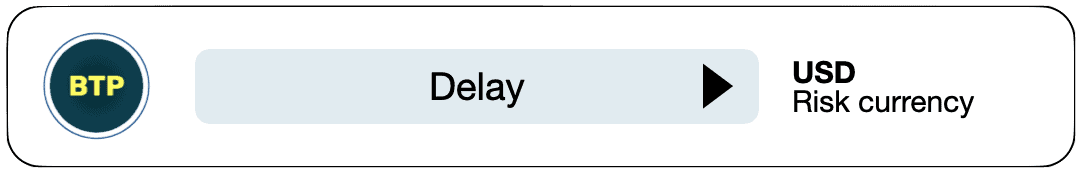

Pay smarter, not just on time.

HedgeGo’s Best Timing Payables (BTP) identifies the optimal moments to make foreign currency payments within a three-week window before the due date. This minimizes the impact of sudden currency rate swings and supports the treasury by reducing repetitive tasks.

BTP uses machine learning models to predict currency trends.

See currency risks before they hit.

HedgeGo’s Pressure Map (PMA) provides treasuries with an early warning if a currency trend is likely to change within the next 5 business days, allowing them to prepare and adjust strategies with confidence.

It is a clear, easy-to-read indicator of the likelihood of a trend shift, on a scale from 10% to 80%.

Curious how our systems work in practice?

Discover how companies benefit in real-life scenarios!

Ready to Optimize Your FX Risk Management?

We provide a transparent pricing for our services.

Still Have Questions?

Feel free to use the contact form below to ask us any of them!

Stay Ahead with Expert Insights

Explore our blog for in-depth market analysis and updates on currency movements.

There Is no Prospect of a Stronger USD

As expected, the Trump administration's defeat has led to a tirade of abuse from the president and his entourage. This is as predictable as it is pathetic. The illegality of the tariffs is obvious. The Supreme Court had no option but to uphold the rulings of the lower...