We are happy to hear from you

Contact

Companies with international business often bear a significant currency risk – either directly, because the clearing currency is a foreign currency, or indirectly, when competitors abroad gain advantages from currency changes that may affect your business.

Fluctuations have an impact on earnings and generate costs; at the same time, currency developments often occur in cycles lasting several years. That’s why our hedging processes and recommendations for risk management are individually tailored to your company’s unique circumstances.

Feel free to focus on your core business – we’ll help you with timing and risk management of your financial results!

Gerhard Massenbauer

CEO HedgeGo

Welcome to our FAQ Section

Great to have you here. Our service helps you as a treasury to get qualified information about predicted FX events. We have summed up most frequent asked questions here, but feel free to contact us for even more information.

Is HedgeGo a trading software?

No. HedgeGo cumulates FX and economical data into suggestions for action that has to be executed by our clients.

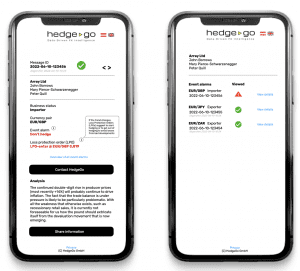

How are FX event alarms communicated?

FX event alarms are communicated to our clients via their preferred communication channels like Email, SMS or messenger services. Look at a sample design to understand our way of achieving the optimal mix of risk protection, administrative effort and hedging costs.

FX event alarms are communicated to our clients via their preferred communication channels like Email, SMS or messenger services. Look at a sample design to understand our way of achieving the optimal mix of risk protection, administrative effort and hedging costs.

How many FX events may I expect per year for one currency pair?

Based on the last 20 years we expect 2-6 FX event alarms per year. As we predict higher volatility in coming years, the number may increase.

Can HedgeGo be used for daily trading decisions?

No. HedgeGo only creates predictions for market trends, not daily market changes. In average, our automated system creates 2-6 suggestions per year for most of our covered currency pairs.

How is the Trial useful for me as a treasurer?

Our Trial aims to give you a back test on your exposures for free as well as one predictive analysis for a predefined currency pair. The Trial ends when HedgeGo has delivered all information to you. Feel free to see our pricing for an active subscription here.

Is there a volume limit for one currency pair?

In general. there is no limit, but we suggest to use HedgeGo for exposures more than 5m for one currency pair.

Will HedgeGo increase my profitability?

Primarily, no. HedgeGo aims to hedge the financial result of multi-currency exposures to avoid losses on FX market volatility. On the other hand, our system leaves room to use opportunities. Over the last decade, HedgeGo has created a 7% performance advantage compared to 80% hedging strategies.

Are there documented, successful market predictions accessible?

Yes there are, please find a selection of events that has been predicted correctly here. For more information, please use our contact form.

How are FX event alarms structured?

Firstly, FX event alarms consist of a analysis section, in which the “Why” is explained in detail. Secondly, our system creates suggestions for concrete hedging orders to executed by our clients.

How can treasuries profit from the service?

Treasuries face multiple challenges. One of it is to keep updated on market developments and to draw conclusions of it. HedgeGo and its proprietary system of analysts and automated intelligence creates analysis and concrete suggestions for action. That saves time and offers easy digestable help.