#FX

Intelligence

How our year

has been?

Great so far. We are constantly improving our service

Treasurers need to identify the mix of long- and short-term assets in their corporation that work for them and ensure that their FX needs are hedged against adverse movements. We are here to help.

How was

your last year?

For our clients,

FX intelligence refinanced itself

15-fold in average

![]() Underlying

Underlying

analysis processes checked by Deloitte

Clear Call to actions and Loss protection orders for your FX management. Click to see a demo preview.

Still no access? Find the button to activate your access further down.

Trust the number 1: What clients

say about our FX intelligence

“HedgeGo is the perfect tool to reduce risks and save costs in FX exposures. Out of personal experience I can highly recommend treasurers to use this source of profound global FX intelligence.”

Nick Kraguljac

CEO, iTac

“Managing multi-currency revenues is a quite a challenging task for treasuries and needs competence and reliability. HedgeGo and its team has delivered excellent forecasts over many years now.”

Petra Reichenbach

Past: Head of Treasury, Rosenberger

Recommended by:

Latest resilience technology

available for your treasury

The innovation lab powered by TMI and set in motion in partnership with J.P.Morgan aims to discover the Fintech and Digital Banking stars of tomorrow. HedgeGo is honoured to be mentioned by such a empowering platform, delivering measurable impact to the treasury world.

Read more about us here

Spot your challenges:

Types of risks and what they

mean for you

1

Transaction

risks

The risk comes from the possibility of the rates changing so that the value of the currency is different than when the transaction started. Transaction risk is directly related to the delay between committing to a deal and actually making payment.

2

Economic

risks

Economic risk is the risk of a company’s value being affected by changing currency rates and is the most complex type of foreign exchange risk. There can be a considerable impact on a company’s market value due to the possibility of volatile movement in the foreign currency market.

3

Translation

risks

Translation risk happens due to the translation of the books into the home currency from a foreign currency. Changes in the exchange rate between the currency in which a company reports and the currency in which it has its assets and liabilities can lead to big impacts on the balance sheet.

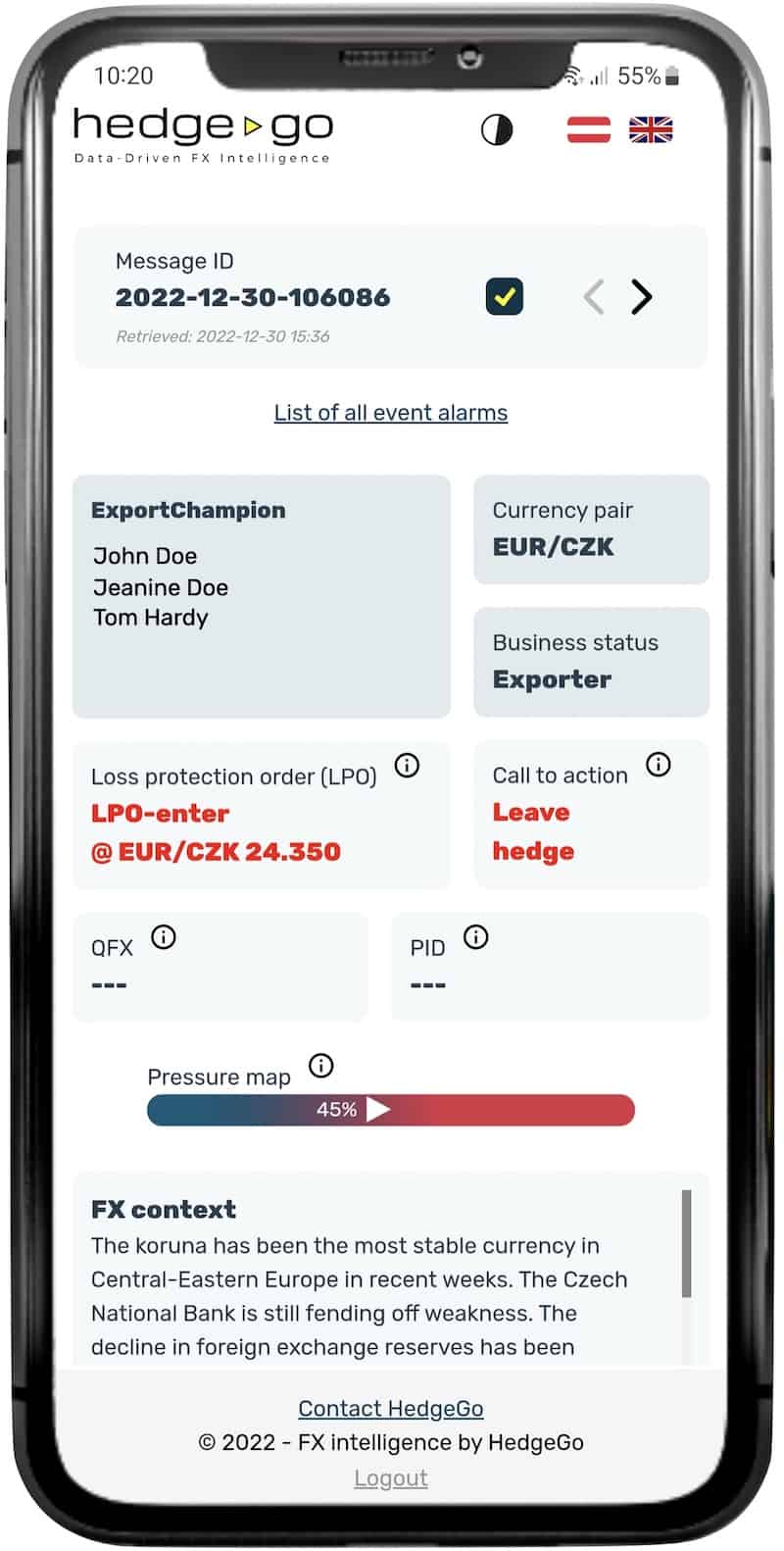

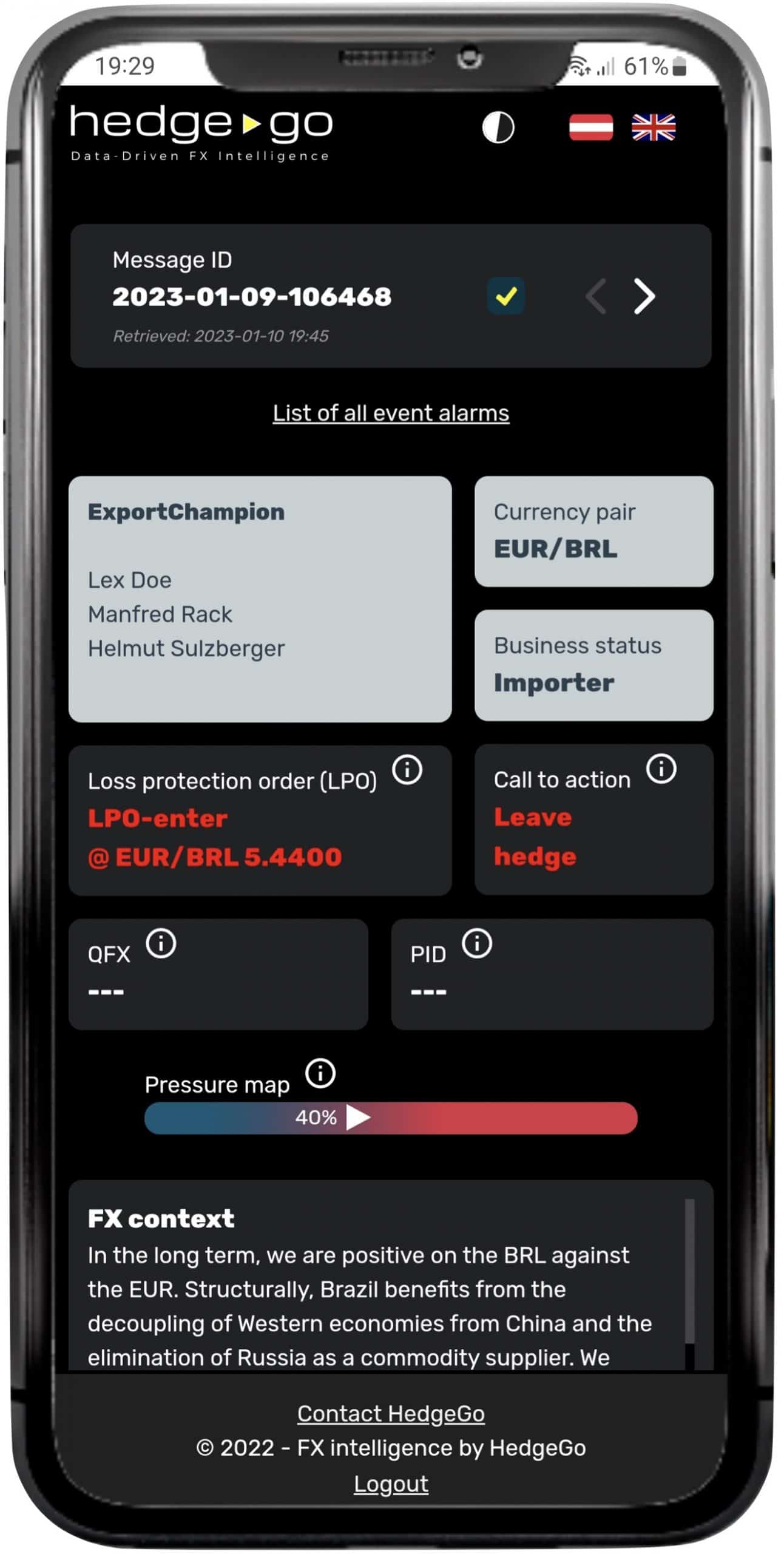

Our solution: Powerful decision data for your exposures

The right timing for decision making in FX processes makes all the difference. We managed to transform our 20-year track record into a simplified FX intelligence. AI-supported data analysis, challenged by human expertise, informs faster about upcoming trend changes. The resulting risks are communicated to treasury via FX Event Alarms on preferred communication channels – simply structured, contextualized and prepared for immediate action.

Call to action

__________

HedgeGo suggests the best timing for executions on the market when it comes for 4 to 16 weeks market evaluations. Our Call to action suggestions consist of 4 stages, "Enter hedge", "Stay hedged", "Leave hedge" and "Stay protected" and trigger your timely executions.

As you understand the nature and risk period of your exposures, use our Call to actions to strive for the

best FX execution timing available.

Loss protection order

__________

Loss protection orders suggest starting or getting out of hedging when a trend changes against all odds. We never allow your exposures to be open for risk, that's why our LPOs protect you against unfavourable developments.

Use LPOs to reduce your workload, not identifying and evaluating potential trend changes and its consequences by your own. Use our market

proven system instead.

Pressure map

__________

Pressure map shows how likely a currency pair on a scale from 0% to 100% will change its trend within a short period of time. Our algorithms identify potential game changers or consequences of ongoing events and deliver a visual output to you.

Use Pressure map for a daily quick check to identify potentially necessary "closer looks" into certain currency pairs and connected exposures.

Predicted FX rate

__________

Predicted FX rate for forecasts (PXR) allows for a dynamic adaption of forecasts. A major part of companies we have reviewed use spot rates in Q4 to build forecasts for the coming year. In reality, such rigid systems don't work, especially in times like these.

Use our PXR to create more precise forecasts and to update them each quarter. Such agile and dynamic management allows for precise KPI control and

great profit simulations.

Predicted interest rate

__________

Predicted interest rate difference (PID) allows for a better valuation of hedging costs. Permanent hedging reduces risk but comes with a hefty price tag. Our algorithms evaluate coming differentials and and deliver data on demand.

Use our PID data to improve cost calculations or simulations for a better cost control. In volatile market environments such information can be a real game changer

for your treasury.

FX event context

__________

Spread sheets full of complex data show control, contextual explanations of correlations and reasons for decisions show superior understanding of modern management. Corporates with international and sometimes decentralized decision mechanisms must rely on the precise understanding of each step done.

Use our analysis texts (in written form and additionally provided as audio files) to spread the understanding

of

FX-related decisions made.

Best timing payables

__________

The timing of invoicing/payment in foreign currencies can have a significant impact on profit margins. This applies to intercompany payments as well as payments/revenues to/from suppliers/customers.

Use our BTP (best timing payables), based on our trend forecasts and valuations, for the right timing of FX-affected payment flows or invoicing.

Best performing currency

__________

It is challenging to manage income statements, balance sheets or cash flow exposures by shifting the cash inflows into currencies expected to be strong or increase exposed cash outflows denominated in weak currencies. E.g., trying to increase their exposure under debts, cash flows and receivables in strong currencies and increase borrowings in currencies that are weak.

Use our BPC ratio

(Best Performing Currency) to optimize performance

in your FX environment.

Call to action

Well-timed call to action for FX strategies based on trends. Goal: Balanced protection of cash flow at risk and value at risk.

As you understand the nature and risk period of your exposures, use our Call to actions to strive for the best FX execution timing available.

Loss protection order

Protection against unexpected trends. Goal: Balanced protection of cash flow at risk and value at risk.

Use LPOs to reduce your workload, not identifying and evaluating potential trend changes and its consequences by your own. Use our FX intelligence system instead.

Pressure map

Shows how likely a currency pair is to change its trend within the next 5 business days. ToDo: Check positions, volumes and maturities at PMA>80%.

Use Pressure map for a daily quick check to identify potentially necessary "closer looks" into certain currency pairs and connected exposures.

Quarter forecast rate

Forecast of the next quarterly FX rate.

Goal: Market-oriented valuation of balance sheet rates.

Use our QFR to create more precise forecasts and to update them each quarter. Such agile and dynamic management allows for precise KPI control and great profit simulations.

Quarter interest rate differential

Forecast of the interest rate differential for the next quarter. Goal: Decision support for hedging transactions.

Use our PID data to improve cost calculations or simulations for a better cost control. In volatile market environments such information can be a real game changer for your treasury.

Best timing payables

Timing suggestion for the next 5 working days to settle outstanding debts promptly or to wait with it. Goal: Profit optimization of payables.

Use our BTP (Best Timing Payables), based on our trend forecasts and valuations, for the right timing of FX-affected payment flows or invoicing.

Cash conversion timing

Proposal for the next 30 days to hold cash in risk currency or convert it to base currency. Goal: Avoid negative currency effects for cash positions.

Use our CCT (Cash Conversion Timing) to optimize performance in your FX cash flows.

From data-driven

FX intelligence

to simplified

Event

Alarms

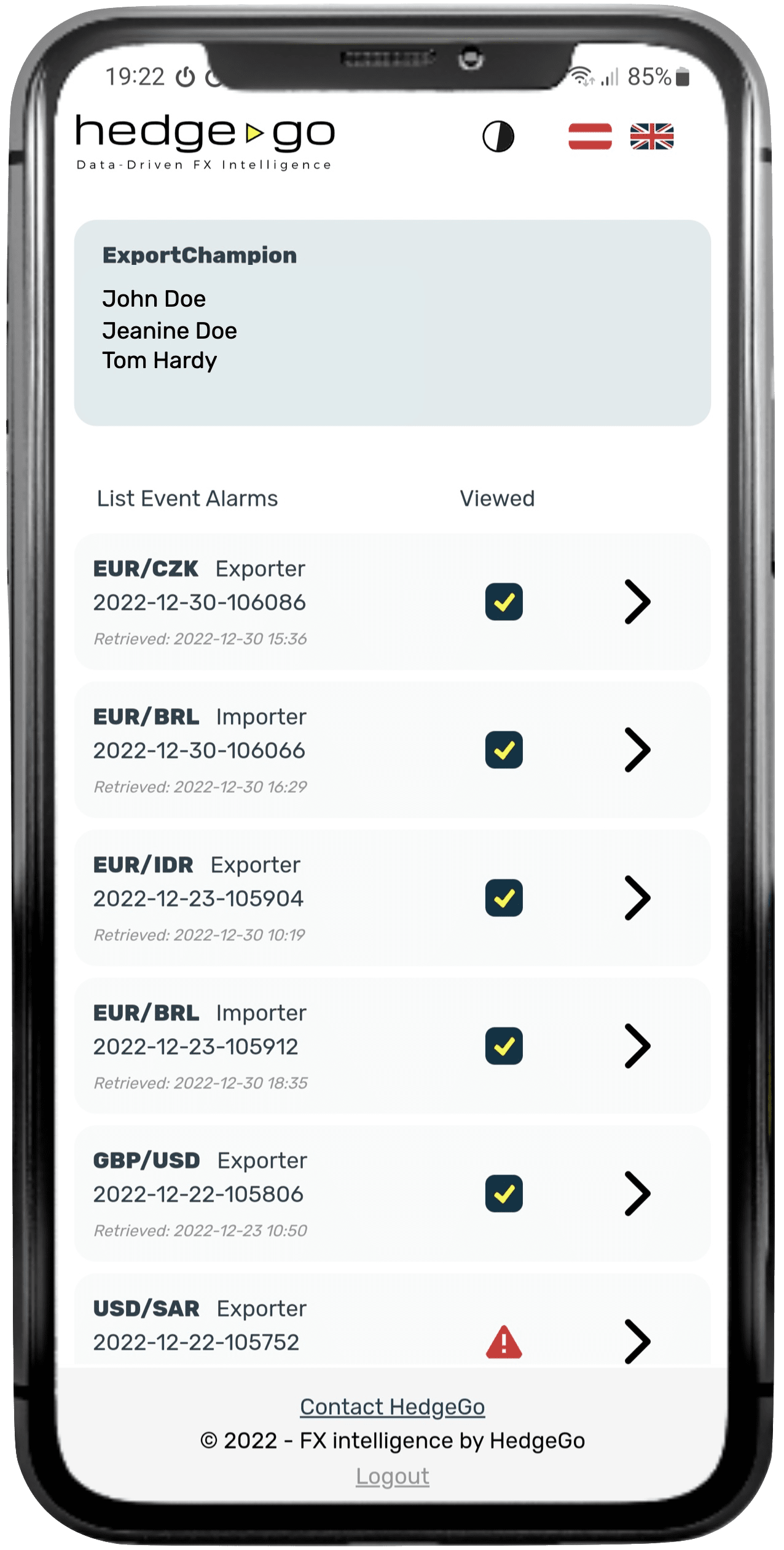

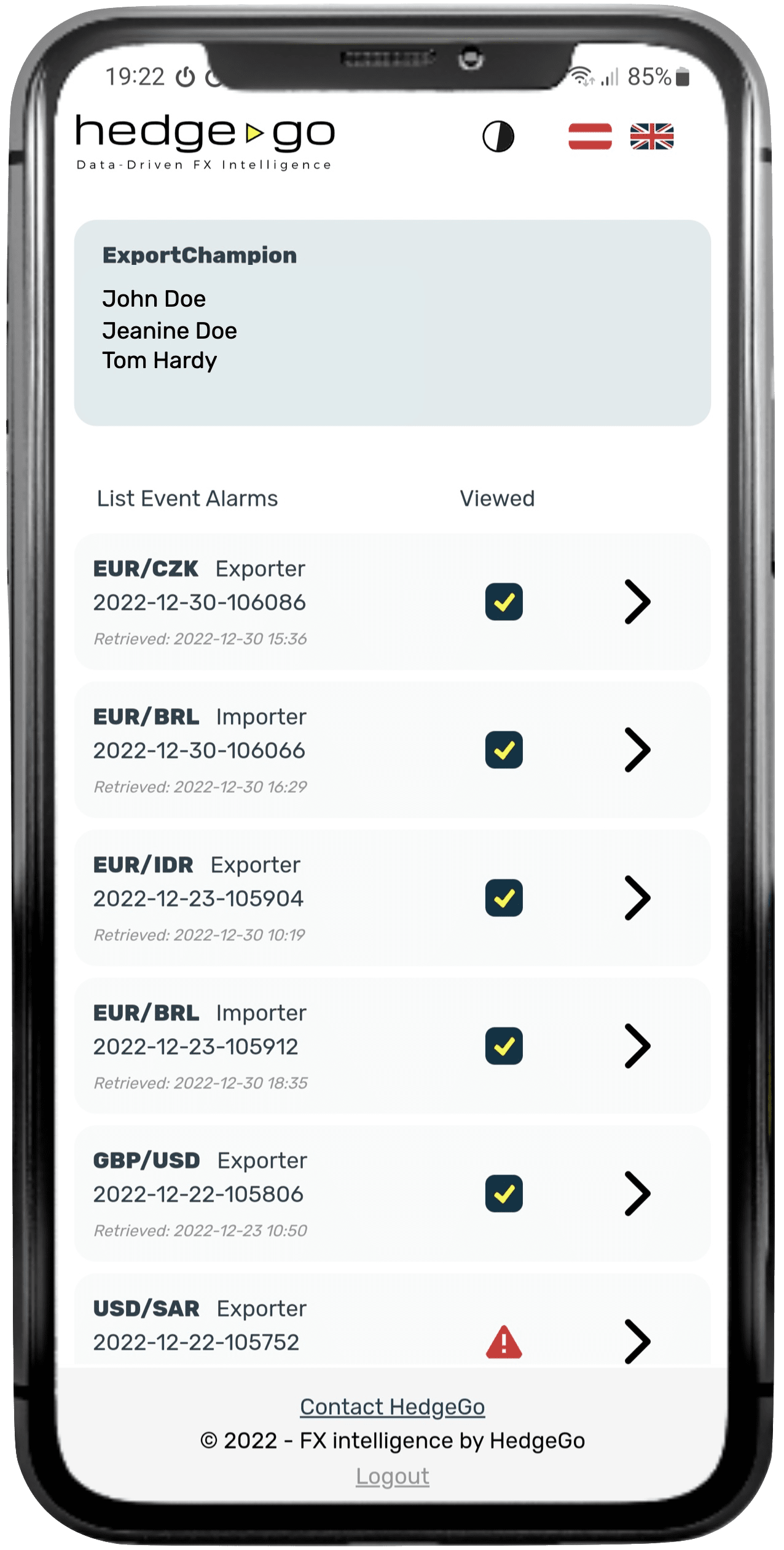

AI-supported data analysis, challenged by human expertise. FX Event Alarms are your new in-house FX intelligence, informing you of upcoming trend changes and associated risks. We communicate our FX Event Alarms on your preferred communication channels – simply structured and ready for quick implementation.

How real time FX Event Alarms improve your FX exposure management

In-time updates on foreign currency developments that affect your balance sheet. Our event alarms allow efficient management of risks and hedging costs, with little effort. All important information is communicated to the right managers in your treasury, enabling quick action.

“We at Loacker use Event Alarms to reduce our translation risk in an agile and systematic way, profiting from superior timing in our FX decision process.”

Dieter Schatz

CFO, Loacker Recycling

FX intelligence in a

new reality

We dig deeper,

assess more data,

and understand earlier

what happens

in the FX market.

For you, this means better timing for periods

to be hedged or cost avoidance in non-critical periods.

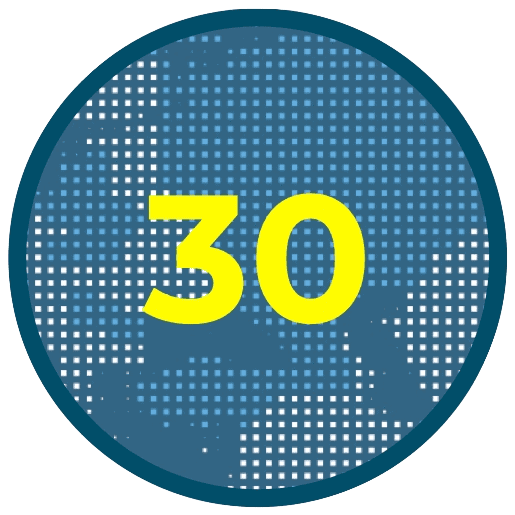

HedgeGo in numbers:

30 currency pairs ready

for you

The analysis of currency developments is a highly specialised activity. HedgeGo provides top notch results for 30 major currency pairs.

22 years of documented track record

It all started in 1999 and has become a success story since then. Such a documented positive track record can’t be copied easily.

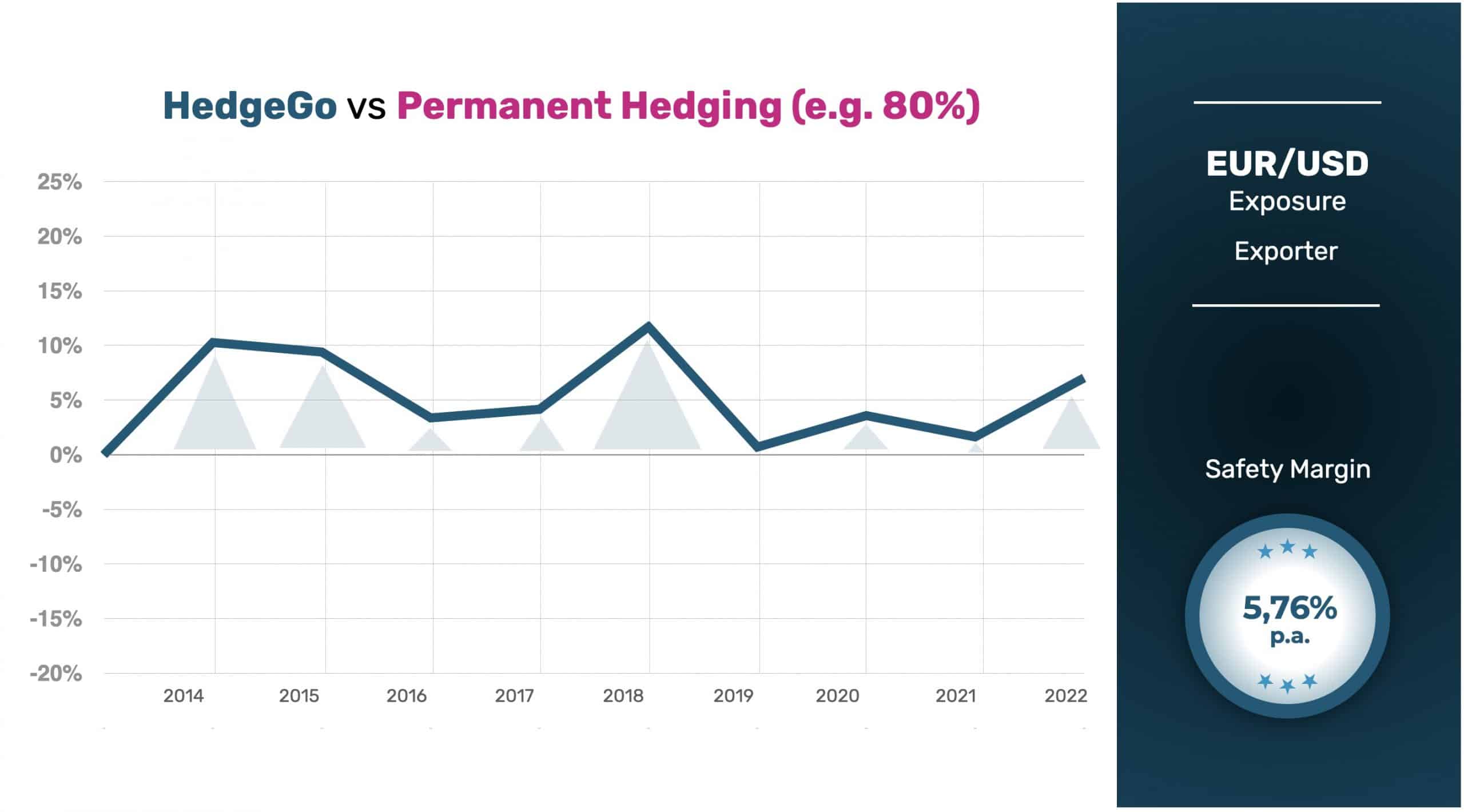

In average 4% higher profitability p.a.*

Major international companies count on our expertise, as the usage of HedgeGo results in a 4% better performance per year. Read more about here.

*Numbers are stated from past periods and are no guaranteed predictions

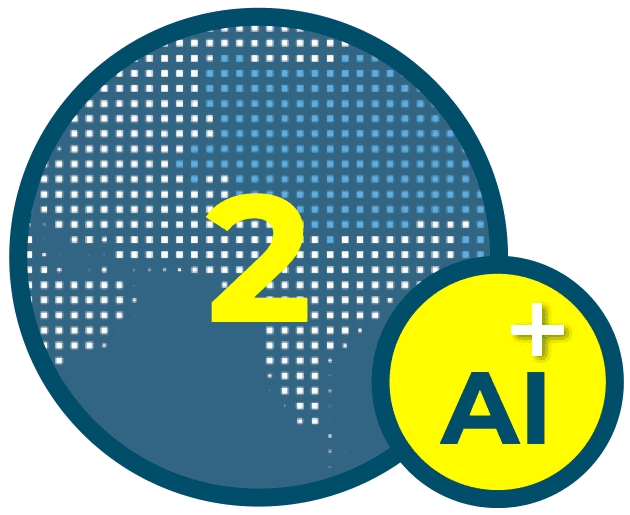

AI engine plus human monitoring

We have started to transform our 22 years of profound expertise into an AI-powered engine, successfully monitored by humans.