Minimizing risk, reducing costs:

strategic impacts when using FX intelligence

Our FX intelligence identifies major FX trends sooner and allows for well-timed Loss Protection Orders (LPOs), enabling corporates to engage our service to their advantage.

Find out, how you can use it in your environment:

Use Case: Loacker Recycling

Hover over to get more information about our client Loacker Recycling and how they use FX intelligence to their advantage.

Centralize treasury

Managing holdings and centralized treasuries can be a demanding strategic job. Our Event Alarms are the first step to control FX exposures and streamline decentralized activities.

Contact us for more info

Fund corporates

Highly volatile business environments as seen these times need proper funding. If FX gets involved our Event Alarms are one important step to support your funding strategy.

Contact us for more info

Manage risk

Automizing risk evaluations, creating “one voice” and succeeding in today’s times as “mother of tail events” need a clear address. FX intelligence and Event Alarms are here for your support.

Contact us for more info

Refine forecasts

Use Event Alarms to run your profitability forecasts on the most agile and reliable system on the market and follow international corporates’ best practice for forecasting FX developments and its impacts.

Contact us for more info

Create transparency

Establish company-wide transparency for your FX strategy decisions based on HedgeGo’s Event Alarm system. Include all decision makers to receive the same transparent data at the same time as you.

Contact us for more info

Run simulations

Before starting with FX Intelligence in practice, HedgeGo enables corporates to run simulations for their exposures. This useful feature shows all relevant KPIs for a further, fact-based FX decision process.

Contact us for more info

Why

now

Control your capital risk:

Actively protected in good times.

Hedged in bad times

Permanent hedging puts an undue burden on the cost side, not hedging carries great risk in times like these. Our FX intelligence allows companies to leverage the best mix of protection and costs.

Translate HedgeGo into your business:

Key ratios driven by FX influence and

how to optimize their output

The most important starting point for managing currency risk is understanding corporate cash flows, i.e., where the money comes from, where it goes, and in what currencies. What is showing up on the balance sheet that could potentially be risky, and what could be discovered by analyzing incoming and outgoing cash flows. Insight into the company’s cash flows and liquidity position is the starting point for currency hedging.

You need help to translate decision data into your processes?

We cooperate with well-known global consulting firms to translate our FX intelligence data into your proprietary processes

NEW

Use case:

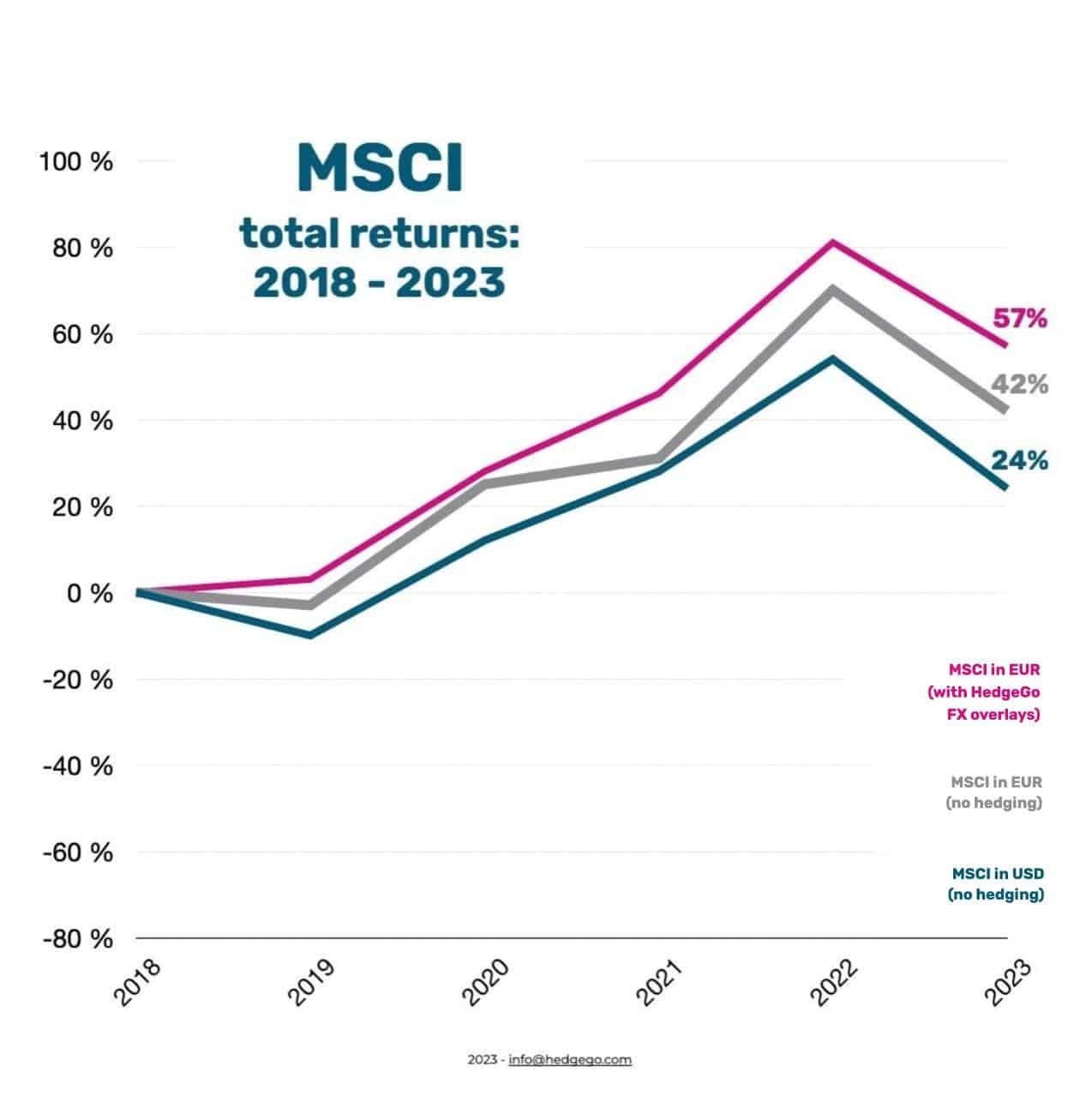

FX overlays for investment funds

Use our Event Alarms to take advantage of positive exchange rate developments. The additional returns generated can be used for re-investments to achieve a measurable increase in value. Such a systematic strategy shows considerable success over a period of 5 years and sustainably improves your competitiveness over longer periods of time.

Use Case:

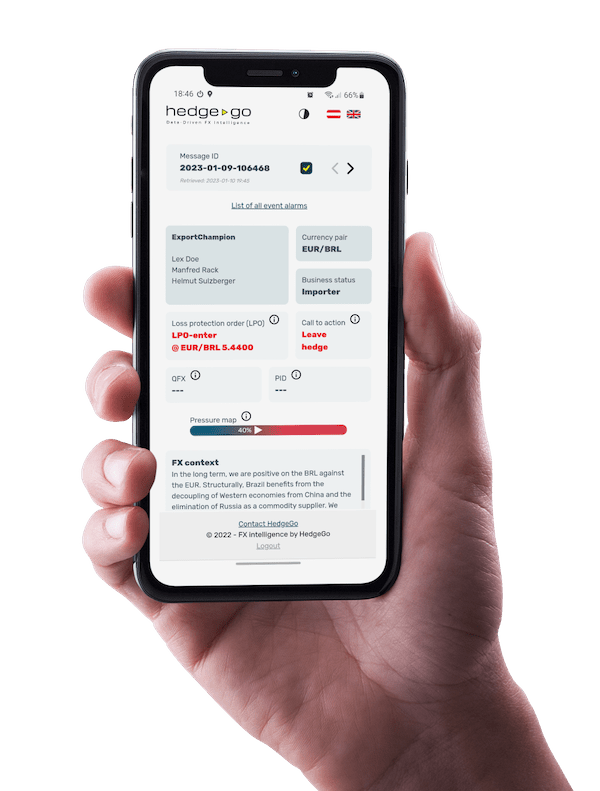

Importer EUR/BRL

A corporation is seated in the EU and buys goods in BRL. Each move in the exchange rate has direct impact to the financial result. Though, the corporation wants to protect itself against unfavourable exchange rates and thinks of hedging action. Based on our 22 year track record we delivered a superior result compared to other alternatives.

Use Case:

Exporter EUR/USD

A corporation is seated in the EU and exports machines to the USA, managing revenues in USD. The past has shown, that their financial result was severely hit in certain years. As a result, the corporation wants to protect itself against unfavourable exchange rates and thinks of hedging action. See, how the HedgeGo Safety Margin has developed for them in past years.

Let 22 years of positive track record influence your profit

Gerhard Massenbauer

Austria’s most renowned expert

for global FX analysis