Trust the number 1:

Optimize your mix of hedging costs

and risk coverage by using

data-driven decisions

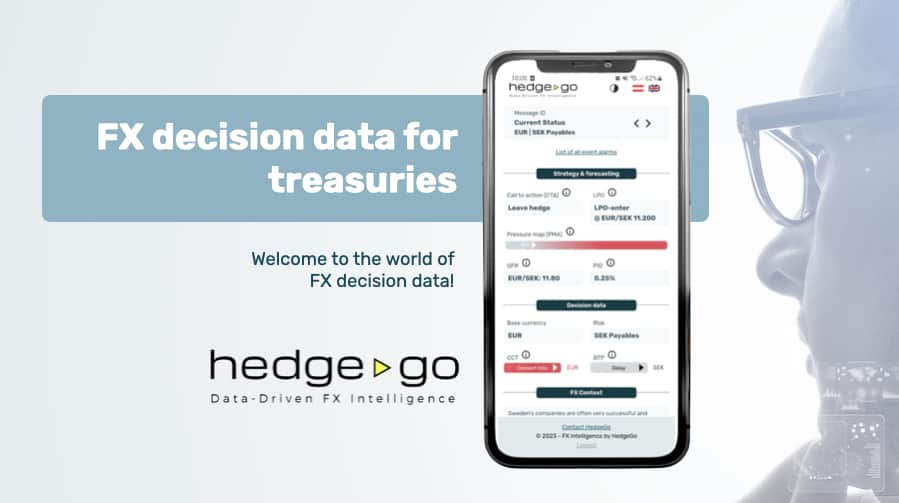

While permanent hedging burdens your cash flows, missing hedges can lead to substantial losses. HedgeGo balances your cash flow at risk with your value at risk based on profound automated FX market analysis. Experience the new generation of FX decision data for a faster, better and easier management of your FX exposures.

controlled by FX decision data

currency pairs available

%

Up to 2% higher profitability p.a.

Best practice: How our clients save time and make better decisions

We offer a best practice exchange with our existing clients. Get in touch with treasuries that already use our technology. Send us a request and we connect you with our clients.

Nik Kraguljac

CEO iTac

“HedgeGo is the perfect tool to reduce risks and save costs in FX exposures. Out of personal experience I can highly recommend treasurers to use this source of profound global FX intelligence.”

Petra Reichenbach

Past: Head Treasury Rosenberger

“Managing multi-currency revenues is a quite a challenging task for treasuries and needs competence and reliability. HedgeGo and its team has delivered excellent forecasts over many years now.”

Dieter Schatz

CFO Loacker Recycling

“In spring 2022, HedgeGo, with its chief analyst Gerhard Massenbauer, was the only source that pointed to a very likely possibility of sharply rising interest rates.”

Implement now:

Automated decision data for your treasury

We run an automated analysis environment to deliver relevant decision data to FX treasuries. Our Goal: to improve business resilience and competitiveness.

The automated information, which is constantly improved by algorithms, provides a condensed view of relevant developments, reduces the effort required for decisions and enables an improved balance between cash flow at risk and value at risk.

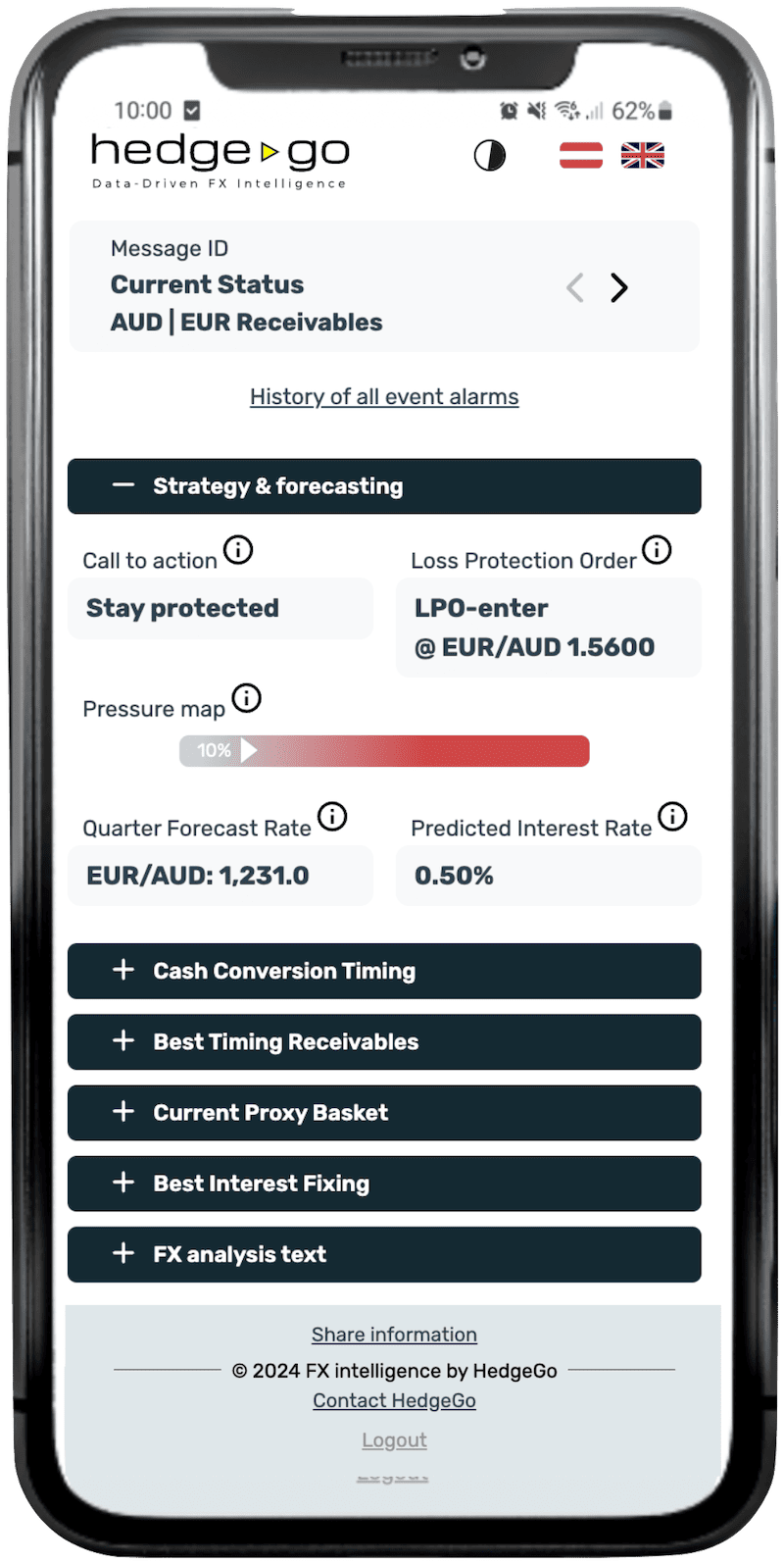

Call to action

Well-timed call to action for FX strategies based on trends. Goal: Balanced protection of cash flow at risk and value at risk.

As you understand the nature and risk period of your exposures, use our Call to actions to strive for the best FX execution timing available.

Loss protection order

Protection against unexpected trends. Goal: Balanced protection of cash flow at risk and value at risk.

Use LPOs to reduce your workload, not identifying and evaluating potential trend changes and its consequences by your own. Use our FX intelligence system instead.

Pressure map

Shows how likely a currency pair is to change its trend within the next 5 business days. ToDo: Check positions, volumes and maturities at PMA>80%.

Use Pressure map for a daily quick check to identify potentially necessary "closer looks" into certain currency pairs and connected exposures.

Quarter forecast rate

Forecast of the next quarterly FX rate.

Goal: Market-oriented valuation of balance sheet rates.

Use our QFR to create more precise forecasts and to update them each quarter. Such agile and dynamic management allows for precise KPI control and great profit simulations.

Quarter interest rate differential

Forecast of the interest rate differential for the next quarter. Goal: Decision support for hedging transactions.

Use our PID data to improve cost calculations or simulations for a better cost control. In volatile market environments such information can be a real game changer for your treasury.

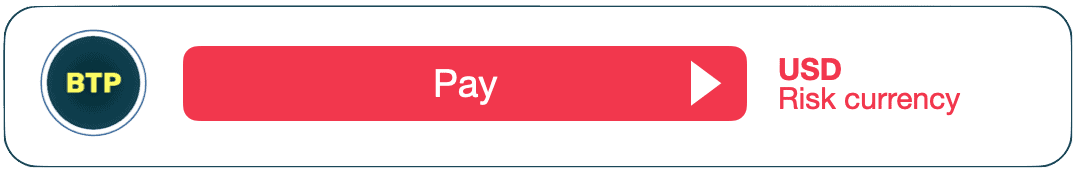

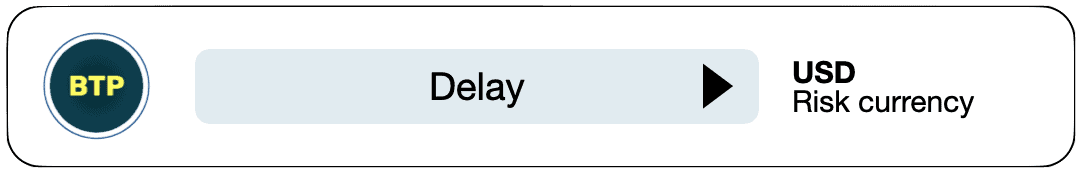

Best timing payables

Timing suggestion for the next 5 working days to settle outstanding debts promptly or to wait with it. Goal: Profit optimization of payables.

Use our BTP (Best Timing Payables), based on our trend forecasts and valuations, for the right timing of FX-affected payment flows or invoicing.

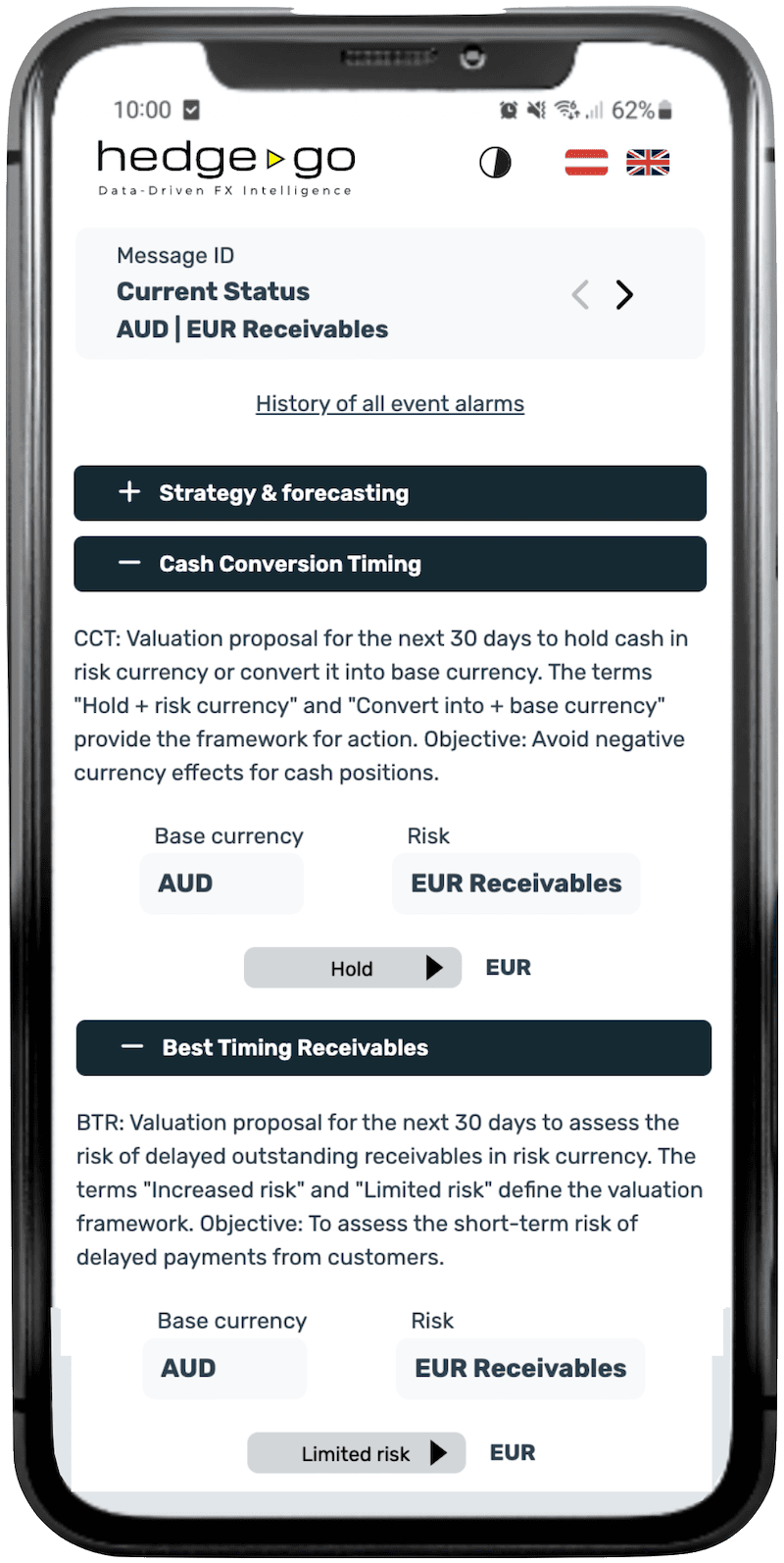

Cash conversion timing

Proposal for the next 30 days to hold cash in risk currency or convert it to base currency. Goal: Avoid negative currency effects for cash positions.

Use our CCT (Cash Conversion Timing) to optimize performance in your FX cash flows.

Call to action

Well-timed call to action for FX strategies based on trends. Goal: Balanced protection of cash flow at risk

and value at risk.

As you understand the nature and risk period of your exposures, use our Call to actions to strive for the

best FX execution timing available.

Loss protection order

Protection against unexpected trends. Goal: Balanced protection of cash flow at risk and value at risk.

Use LPOs to reduce your workload, not identifying and evaluating potential trend changes and its consequences by your own. Use our FX intelligence system instead.

Pressure map

Shows how likely a currency pair is to change its trend within the next 5 working days. ToDo: Check positions, volumes and maturities when PMA reaches 80%.

Use PMA for a daily quick check to identify necessary "close looks" ito certain currency pairs and connected exposures.

Quarter Forecast Rate

Forecast of the next quarterly FX rate.

Goal: Market-oriented valuation of balance sheet rates.

Use our QFR to create more precise forecasts and to update them each quarter. Such agile and dynamic management allows for precise KPI control and

great profit simulations.

Quarter interest rate differential

Forecast of the interest rate differential for the next quarter. Goal: Decision support for hedging transactions.

Use our PID data to improve cost calculations or simulations for a better cost control. In volatile market environments such information can be a real game changer for your treasury.

Best timing payables

Timing suggestion for the next 20 working days to settle outstanding debts promptly or to wait with it. Goal: Profit optimization of payables.

Use our BTP (Best Timing Payables), based on our trend forecasts and valuations, for the right timing of FX-affected payment flows or invoicing.

Cash conversion timing

Proposal for the next 20 working days to hold cash in risk currency or convert it to base currency. Goal: Avoid negative currency effects for cash positions.

Use our CCT to optimize performance in your

FX cash flows.

Example: FX decision data that are solely based on AI-optimized timing

(leading/lagging)

The most difficult decisions appear when it comes to balancing cash flow-at-risk (cost of hedging) and value-at-risk to protect the balance sheet. FX decision data can help speed up processes, save time and better balance costs against risks as they arise.

Cash Conversion Timing (CCT): in time and always accessible

Avoid negative currency effects for cash positions by using the right timing to convert cash from risk currency to reporting currency. For the EUR/HUF currency pair, improved timing of the 2022 cash conversion meant a gain of 2%.

Best Timing Payables (BTP): improve your cash management

Profit from the optimization of your cash management by actively deciding on when to transfer payables to your suppliers. In 2022 this meant plus 8% for EUR/USD.

Pressure Map (PMA): prepare for action

The first sentiment indicator for Treasuries. See on a scale of 10% to 100% how likely the current trend for a currency pair is to change within the next 5 business days. Check your positions and hedging instruments when the PMA reaches 80%.

Best Timing Receivables (BTR): evaluate your risk

When your clients pay later than expected, your risk connected with your FX exposure must be evaluated correctly. For 2022, delayed receivables in INR would have meant an increased risk for 10% loss in value for a German company.

Recommended:

Our resilience technology

powered by AI and available for your treasury

The innovation lab powered by TMI and set in motion in partnership with J.P.Morgan aims to discover the Fintech and Digital Banking stars of tomorrow. Treasury Dragons feature top notch technology for treasuries. HedgeGo is honoured to be mentioned by such an empowering platforms, delivering measurable impact to the treasury world.

FX treasury: less time for good decisions?

The development of inflation, the assessment of risk and volatile foreign exchange markets put even more pressure on their already busy treasury. The result: less time to make good decisions.

Research: this is what corporates think

“We have to put a great deal of effort to monitor FX markets on regular base. That takes away precious time for our internal decision making processes.”

CFO, International retailer

“Our treasury can’t be agile as we would need it because we miss integrated processes and profound expertise.”

Senior Treasury, Automotive

Transparency: Check our performance and view our pricing

When you browse the internet for suitable and performing FX intelligence you often face a problem. The lack of performance transparency makes it hard to understand the real value for your company. With HedgeGo it is different. Use our calculators to view our performance and return on subscription investment.

Good reads: Get the latest insights from the HedgeGo FX laboratory

Wenn Interim CFOs zu Managern der Nachhaltigkeit werden

Interim CFOs und Ihre Herausforderungen Die Beauftragung eines Interim CFOs beinhaltet oft den Wusch des Unternehmens nach einer Änderung oder Transformation bestehender Prozesse und Ausrichtungen. Dabei kann es um den Umbau des gesamten Unternehmens oder auch "nur"...