Your gain: Balance

your cash flow at risk

and value at risk

FX intelligence runs an automated analysis environment to deliver relevant decision data to treasuries.

Our Goal: improve your business resilience and competitiveness.

Reinforced learning algorithms provide a condensed view of relevant developments, reduce the effort required for decisions and enable an improved balance between

cash flow at risk and value at risk.

How Our Solutions

are Used Best

Centralize treasury

Managing holdings and centralized treasuries can be a demanding strategic job. Our Event Alarms help to control FX exposures, streamline decentralized activities.

Contact us for more info

Fund corporates

Highly volatile business environments need proper funding. If FX gets involved, our Event Alarms contribute to support your funding strategy.

Contact us for more info

Refine forecasts

Use Event Alarms to run your profitability forecasts on the most agile and reliable system on the market and follow international corporates’ best practice for forecasting FX developments and its impacts.

Contact us for more info

Create transparency

Establish company-wide transparency for your FX strategy decisions based on HedgeGo’s Event Alarm system. Include all decision makers to receive the same transparent data at the same time as you.

Contact us for more info

Run simulations

Before starting with FX Intelligence in practice, HedgeGo enables corporates to run simulations for their exposures. This useful feature shows all relevant KPIs for a further, fact-based FX decision process.

Contact us for more info

This is our contribution for the new generation of working capital management

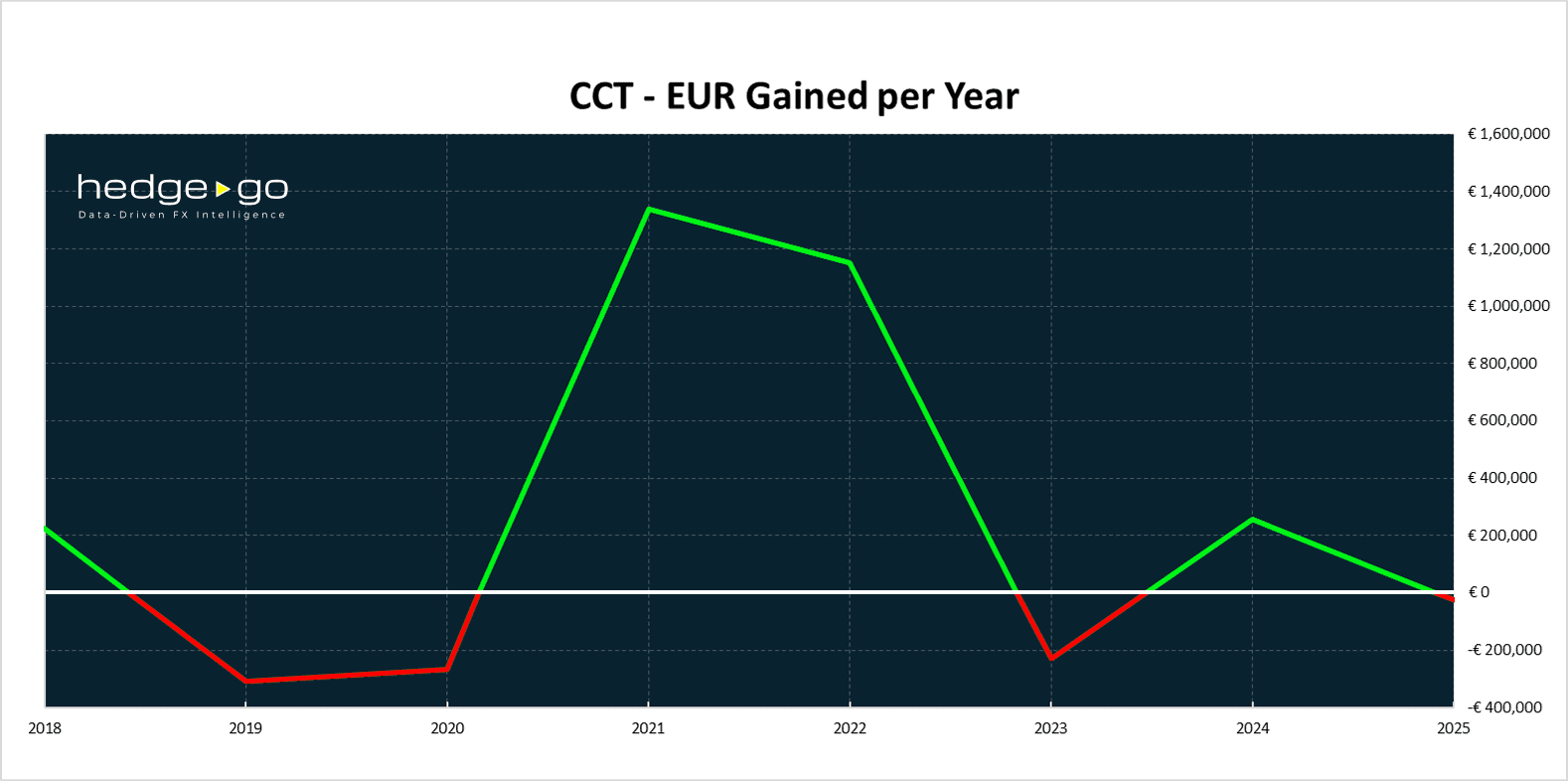

Use Case:

Optimizing FX Receivables with CCT (EUR/CNY, EUR/USD, USD/MXN)

A European company with a EUR balance sheet received more than €88 million in FX receivables (EUR/CNY, EUR/USD, USD/MXN) between 2018 and 2025.

With HedgeGo’s Cash Conversion Timing (CCT), the company boosted returns by 2.3% overall — around 0.32% more per year — simply by optimizing the timing of conversions.

The graph illustrates the additional EUR gains achieved each year through CCT compared to standard conversion practices.

Use Case:

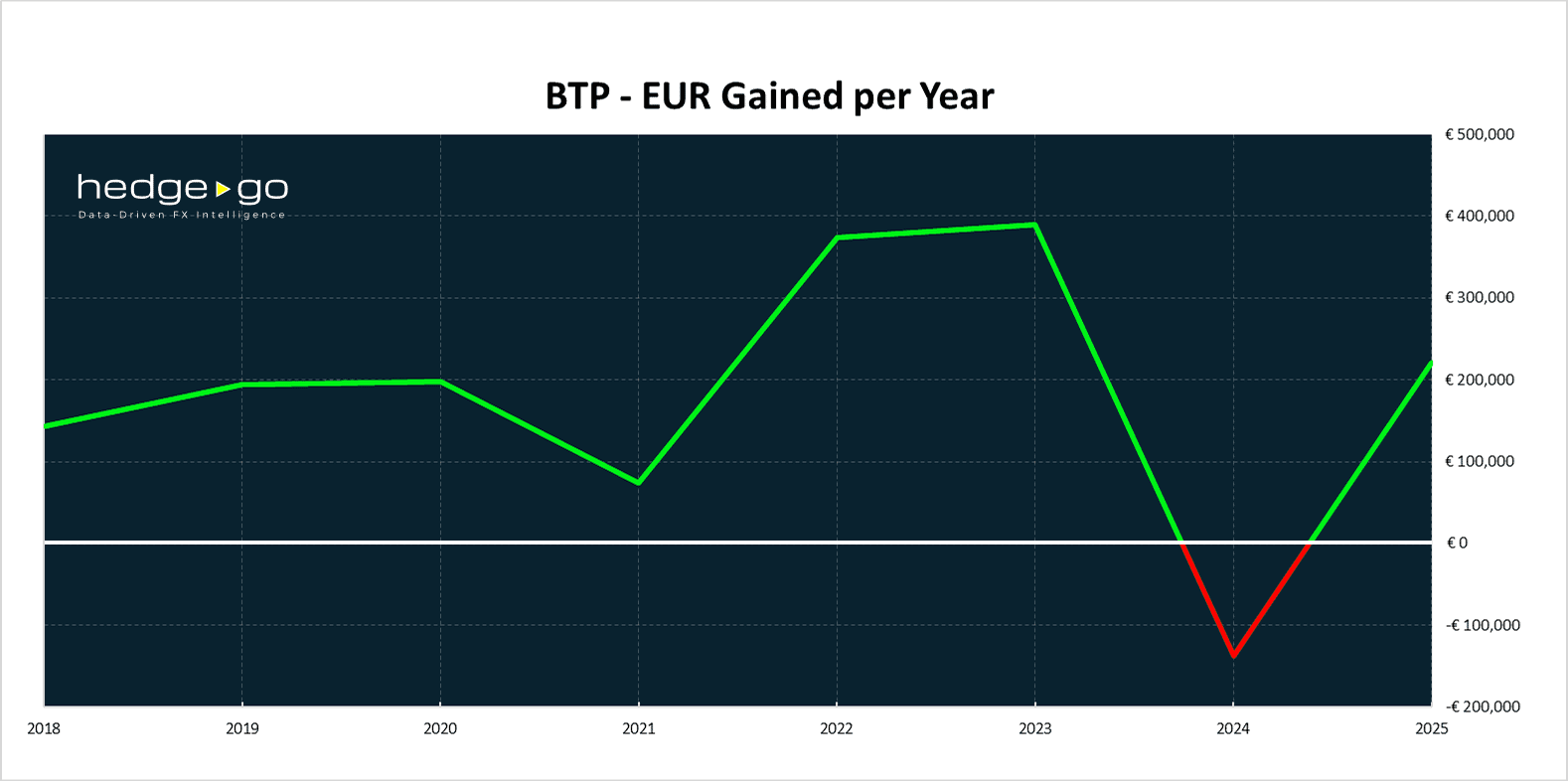

Optimizing FX Payables with BTP (EUR/GBP, EUR/THB, EUR/USD)

A European company with a EUR balance sheet managed more than €140 million in FX payables (EUR/GBP, EUR/THB, EUR/USD) between 2018 and 2025.

By applying HedgeGo’s Best Timing Payables (BTP), the company saved 1.05% overall — about 0.14% per year — simply by timing payments more effectively.

The graph illustrates the annual EUR savings achieved with BTP compared to standard payment practices.

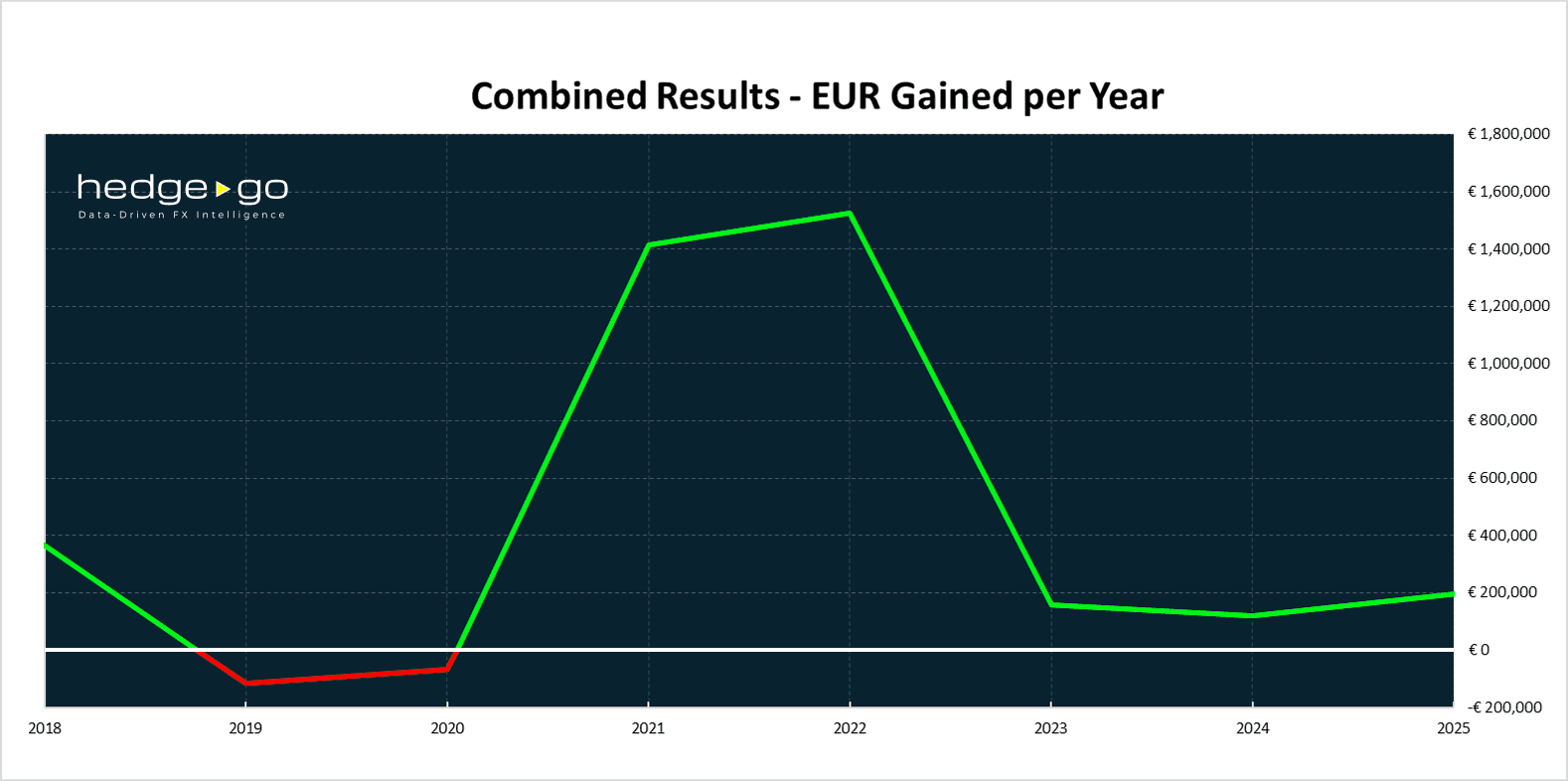

Use Case:

Combining CCT & BTP

for Maximum Impact

When the same European company applied both Cash Conversion Timing (CCT) and Best Timing Payables (BTP) across €228.6 million in receivables and payables (2018–2025), the combined effect delivered an extra €3.6 million in gains.

The graph highlights the additional EUR saved and earned each year, showing how both tools together unlock even greater financial stability and performance.

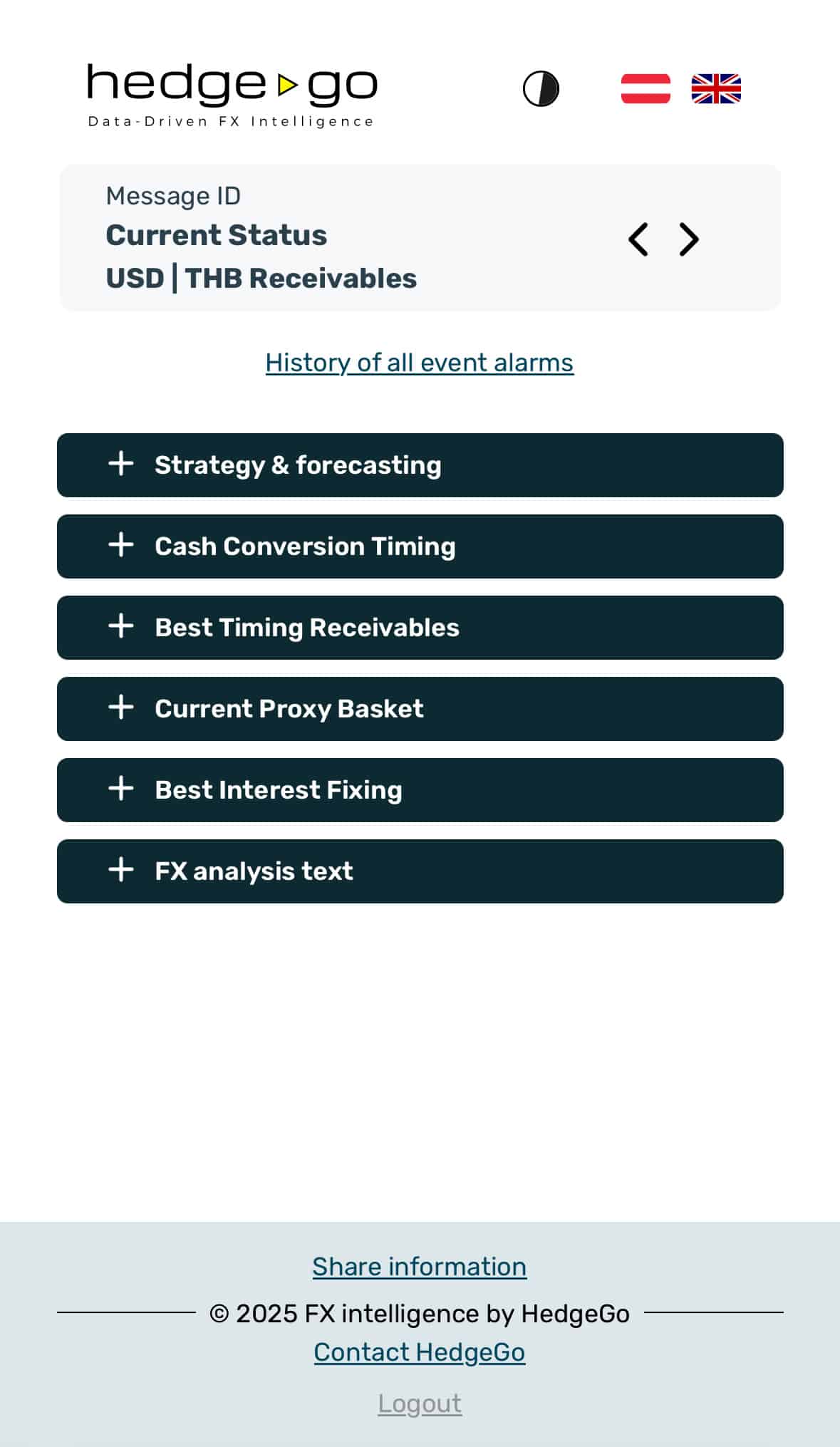

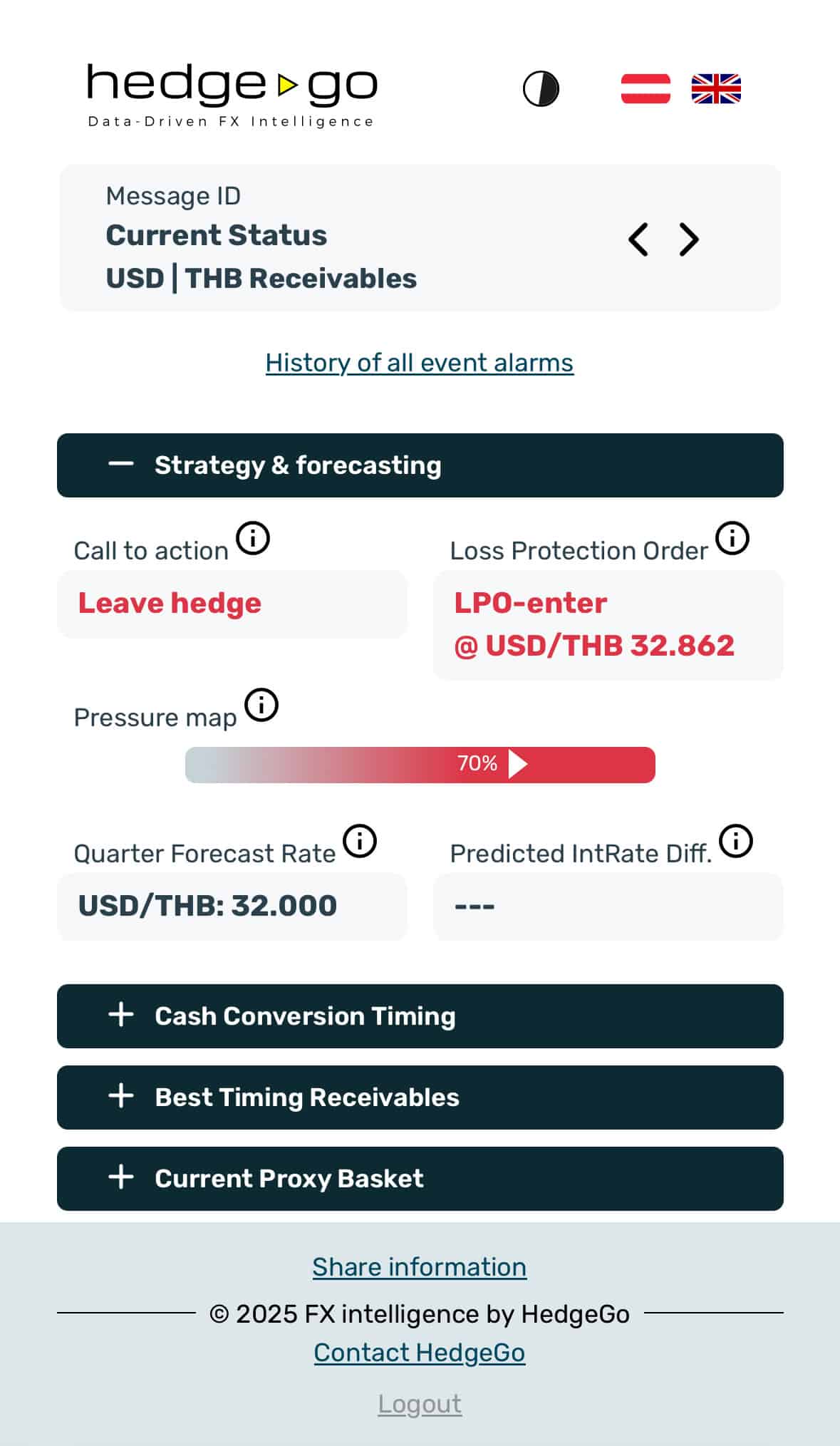

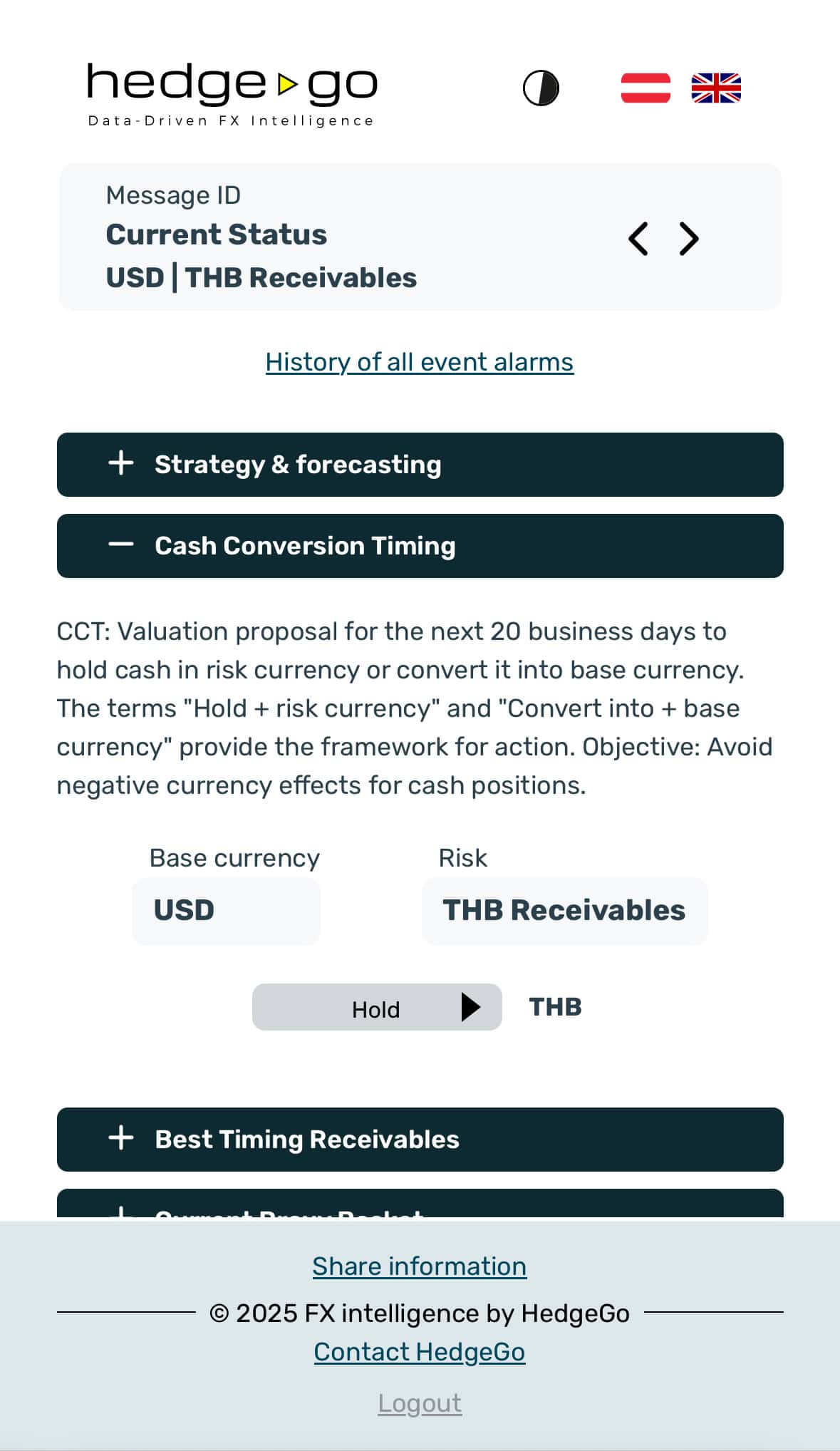

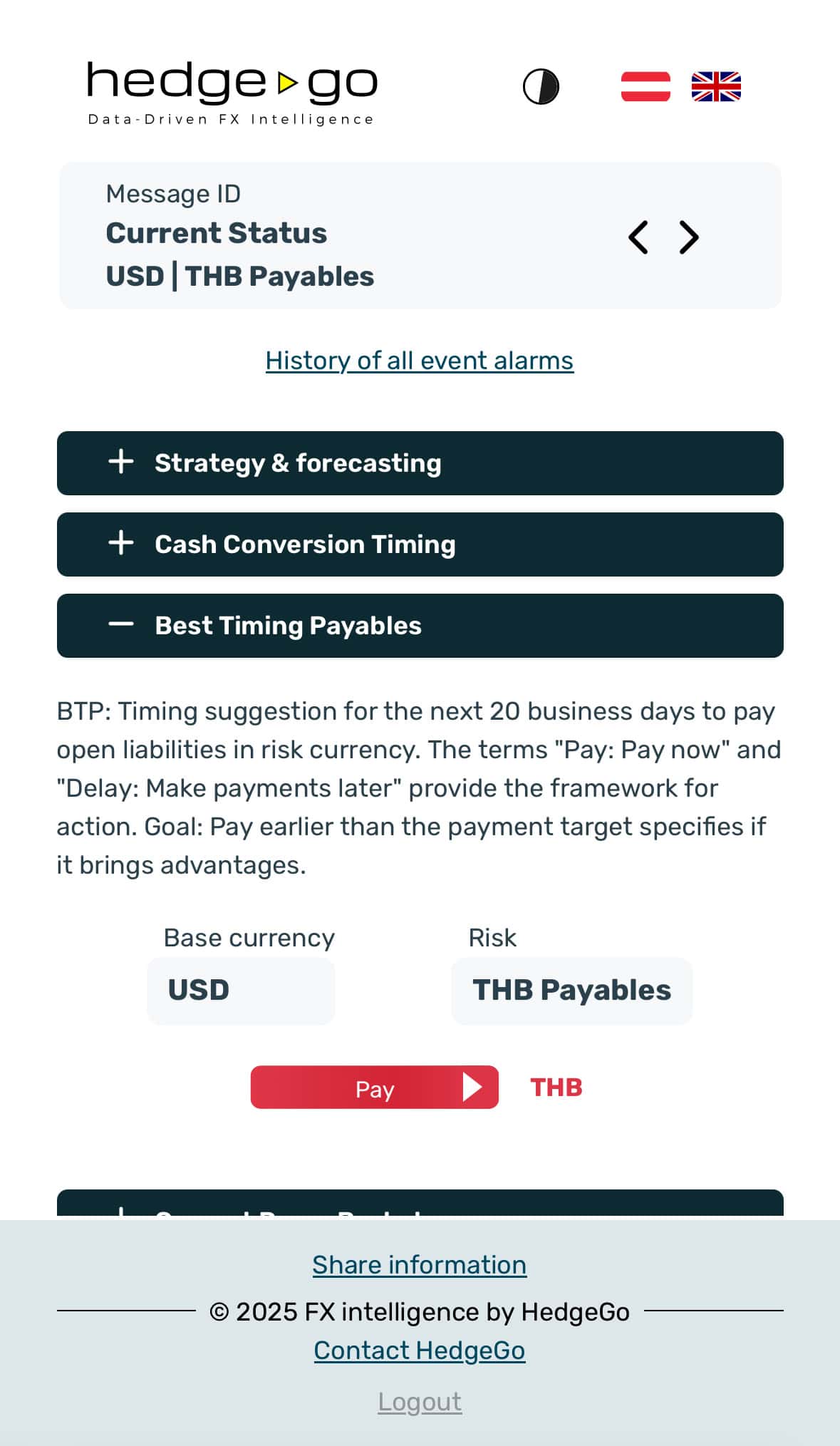

A Glimpse Into the HedgeGo App

See the four core views in action: Homescreen, Strategy & Forecasting, CCT, and BTP.