Full transparency:

Check your

return on investment

How to use our pricing calculator

1. Enter your most exposed currency pairs (up to 3 pairs are possible) by pressing the drop down chevron

2. Enter the exposed FX volume for each currency pair up to 1bn Euro

3. Hit the button “Calculate price”

4. Look at the result sheet to see the annual investment (subscription p.a.) necessary to use HedgeGo

5. See how many times (e.g. 6x) your investment would have been returned as Safety Margin (additional return). The basis for the performance calculation of the Safety Margin is the difference between an 80% hedging approach and our Safety Margin performance.

Example: If your chosen currency pair shows 15X as result, your HedgeGo subscription fee was re-financed 15-fold p.a. by your additional financial surplus (Safety Margin).

(last update: today 08:00 CET).

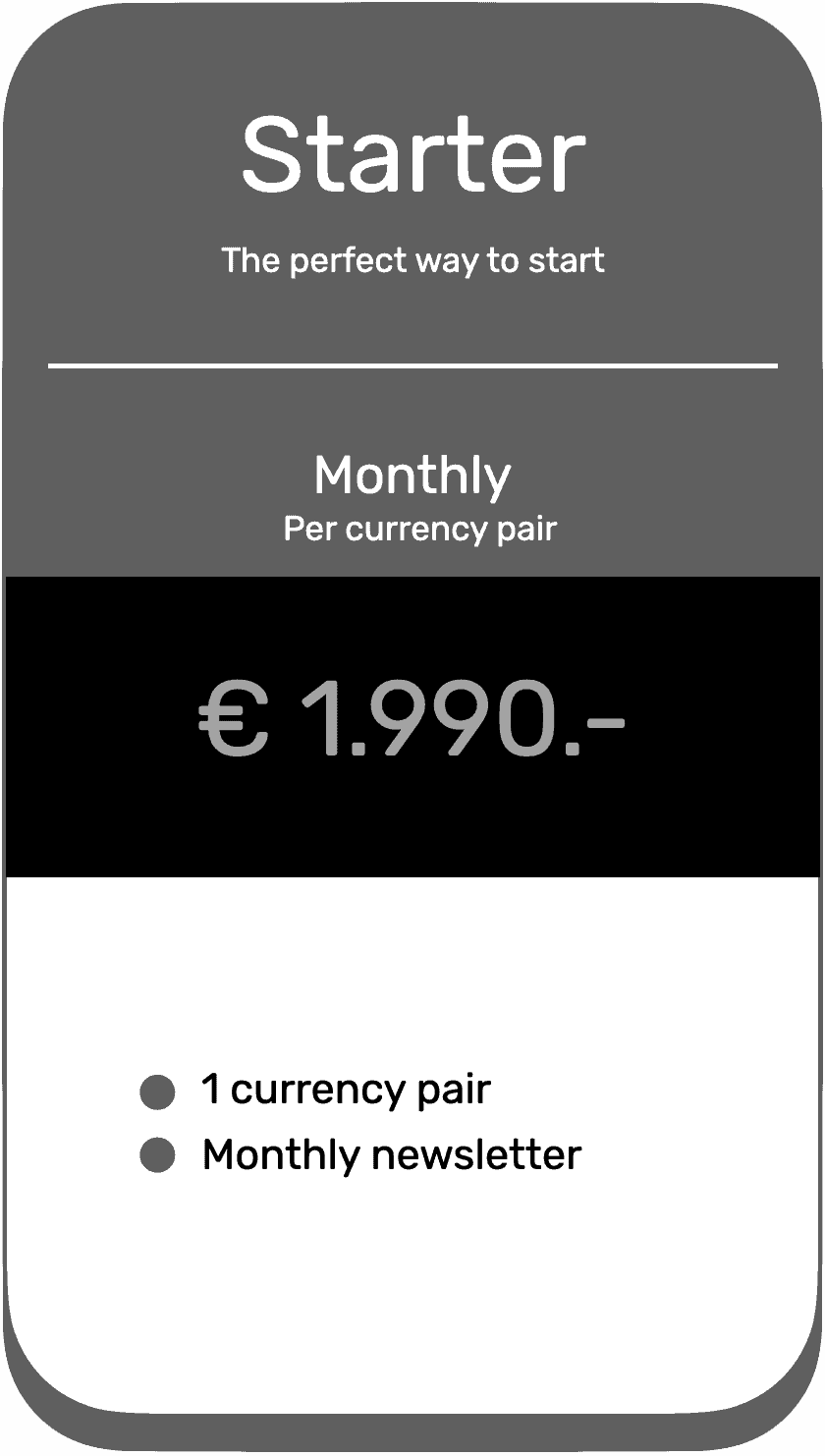

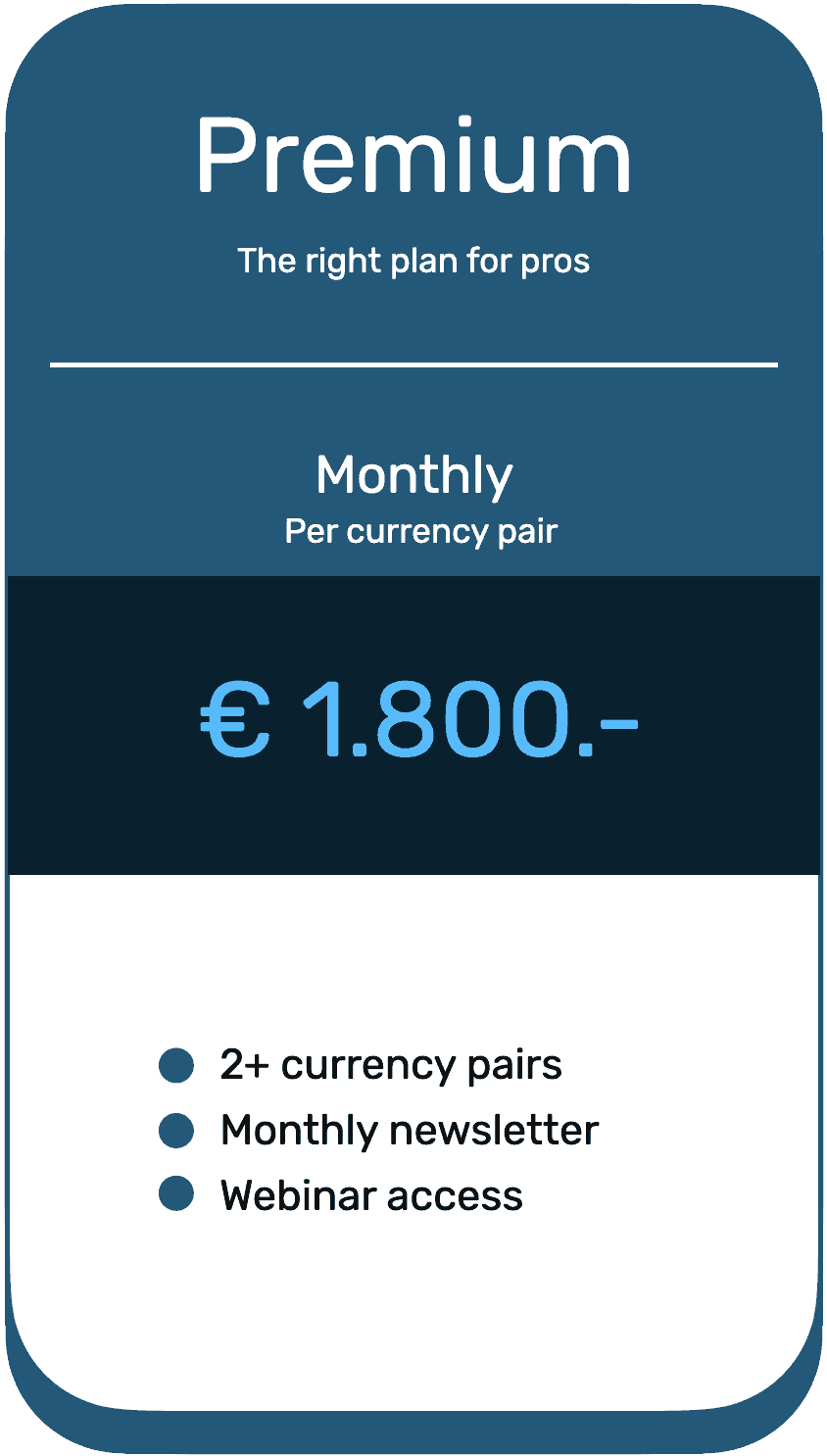

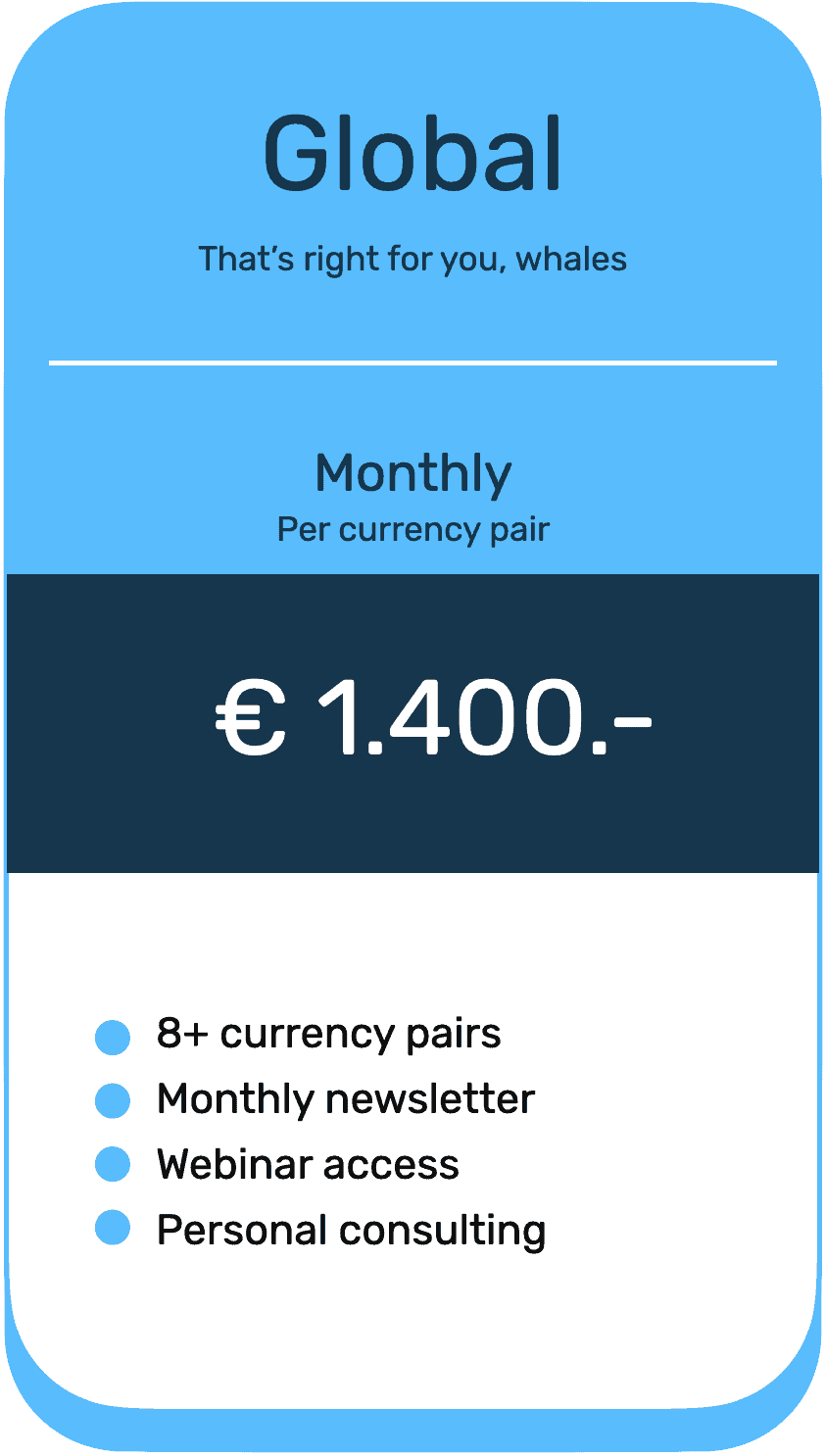

You’ve found the best pricing for your hedging strategy

Services

and pricing tables

HedgeGo delivers alert signals and recommended action plans to its clients. Supporting communication channels like Webinars and published market analysis additionally explain the “Why” behind the “What” to responsible FX managers. For special needs, HedgeGo recommends to contact licensed companies that offer tailor-made financial instruments, meeting all your challenges when dealing with FX exposures.

Our pricing aligns with the challenges faced by our clients and is calculated on the amount of currency pairs hedged plus the volume dealt in exposures.

Contact us today

to get your personal quote.

Claudia Haarer

Head Client Success, HedgeGo